The Fed’s housing market “reset” has officially triggered the second largest housing price correction of the post-war period

In June, Fed Chair Jerome Powell told reporters that the overheated US housing market – which has seen US house prices rise by over 40% in just over two years – needs a “reset”. And higher mortgage rates would slowly “rebalance” the market, he said.

“We saw [home] Prices have risen sharply in recent years. That’s changing now… I would say if you’re a homebuyer, someone or young person looking to buy a home, you need a bit reset to default. We need to go back to a place where supply and demand are coming together again,” Powell said.

While Powell wasn’t sure what the Fed’s housing “reset” would mean for house prices, wealth There was speculation that prices would fall. It looks like we’re right.

US home prices fell another 0.8% in September, according to the latest Case-Shiller report released on Tuesday. This is the third straight monthly decline in home prices since Powell’s June statement. Prior to 2022, the seasonally adjusted Case-Shiller National Home Price Index had not posted a month-on-month decline since the trough of the 2012 housing crash.

This latest Case-Shiller report – which found a 2.2% decline in US home prices since June – means that we have entered the second-largest post-war home price correction. On paper, it ties in with the 2.2% drop between May 1990 and April 1991, but since the index is a three-month moving average, we know October’s numbers will surpass that mark. However, it’s still well below the 26% peak-to-trough decline that occurred between 2007 and 2012.

How can this 2.2% drop already count as the second largest correction of the post-WWII era? It boils down to the fact that nationally, house prices have historically been pretty sticky. Sellers resist going below market prices unless the economy forces them to.

“I think the religion that people had from 1946 to 2008 that house prices are always going up is dead. My parents thought that was literally unthinkable [home] prices are going down,” Glen Kelman said recently wealth. The ensuing housing crash of 2008 broke that “religion” and taught buyers and sellers alike, he said, that house prices can indeed fall. “So people react [now] to [correction] with almost PTSD, and they withdraw much quicker.”

Not only do ordinary people know that prices can fall – the example of 2008 has also made institutional firms and construction companies more vigilant. These companies are a big reason real estate prices are falling so fast right now.

“When the shiitake mushrooms hit the fan, you [investors] want to go out first. The way to do this is to find where the lowest sell is and 2% below that. And if it doesn’t sell the first weekend, move it down [again]’ Kelman said recently wealth. In his view, real estate investors, including Redfin’s iBuyer business and builders, are helping drive prices down faster this time.

Another reason prices could fall so quickly is simply because house prices have risen so much and so quickly during the pandemic. And now that mortgage rates have also skyrocketed, many buyers are either overpriced or have lost their mortgage eligibility entirely.

When asked in September to clarify his comment on June’s housing “reset,” Powell told reporters the US housing market was in a “difficult position.” [housing] Correction.” While this housing correction has clearly arrived, it’s hardly even across the country.

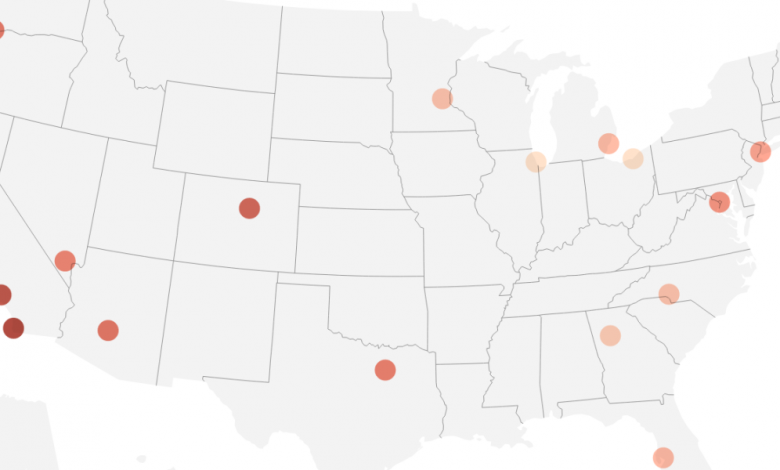

Among the 20 major US housing markets tracked by Case-Shiller, home price declines range from just -0.55% in Atlanta to -10.4% in San Francisco. (Chicago and Cleveland remain at their 2022 peak price).

It’s not just San Francisco: the western half of the country, including markets like Seattle (down 9.16%) and Phoenix (down 3.86%), is clearly the epicenter of the ongoing home price correction. What’s happening? The western half of the country, where affordability is a greater concern, is more vulnerable to interest rate shocks. In markets like San Francisco and Seattle, monetary tightening means their powerful tech job centers are retreating while tech stocks plummet. Meanwhile, higher mortgage rates buoyed seething boomtown markets like Phoenix.

The correction continues to be milder in the Northeast and Midwest. Markets like New York and Detroit are just 1.58% and 0.81% off their respective highs. As the housing cycle ramped up this summer, these markets were not flooded with inventory from iBuyers and builders. That’s given sellers in markets like New York and Detroit a little more breathing room.

It is true that we are in an apartment correction. It’s also true that homeowners are still doing reasonably well overall. In fact, “good” might be an understatement.

So far, the 2.2% price drop of the housing correction between June and September has only pared a small part of the massive 41.29% price surge of the pandemic housing boom. Since March 2020, home prices are still up 38.33%.

Not only have homeowners been protected from rent shocks, many have also benefited from refinancing to 2% or 3% mortgage rates during the pandemic.

Where do we go from here? It depends who you ask.

Zillow economists believe that the property price correction will be complete by January 2023 and we will see property values rise by 0.8% over the next 12 months. Meanwhile, economists at Morgan Stanley, Goldman Sachs and Moody’s Analytics expect house prices to fall about 10% from peak to trough. While firms like Zonda and KPMG believe we are headed for a 15% peak to trough US home price decline.

Of course, when Zillow or Moody’s speak of “US home prices,” they are speaking of a national aggregate. What comes next will certainly vary by market.

Would you like to be kept up to date on the apartment correction? Follow me on Twitter at @NewsLambert.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.