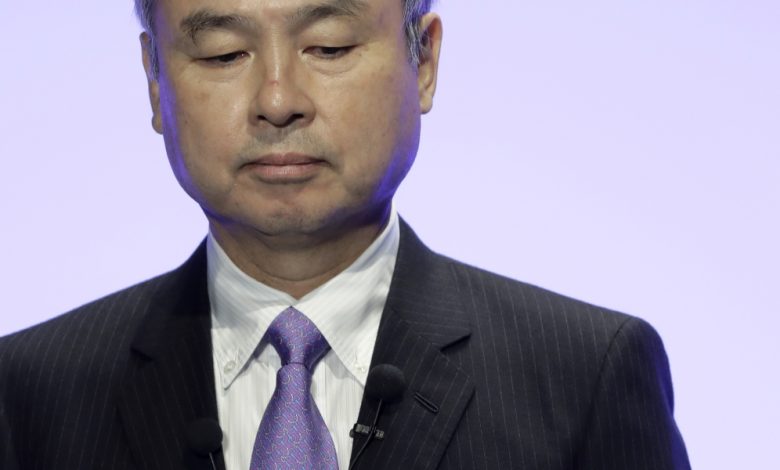

SoftBank CEO Masayoshi Son owes the company $4.7 billion

Masayoshi Son is now personally responsible for approximately $4.7 billion in side businesses he managed at SoftBank Group Corp. to increase his compensation is on the hook after mounting losses in the company’s technology portfolio wiped out the value of its stake in the second Vision Fund.

Over the years, the Japanese billionaire’s controversial personal stakes in SoftBank’s investments have drawn fire from investors, who have pointed to the mix of personal and corporate interests as a concern of corporate governance. Son — who owns a more than 30% stake in SoftBank — has denied there was any conflict of interest, saying it was compensation for his investment expertise rather than investment fees.

The move backfired, wrapping Son’s personal finances in the downside of the world’s largest tech investor’s bets. Son lost more than $4 billion in ancillary businesses in the June quarter, Bloomberg News previously reported.

Son said last week he was stepping back from leading earnings calls to focus on helping chip designer Arm Ltd. prepare for an IPO — an event that would give SoftBank fuel to start making new investments again. SoftBank will wait out a tech winter and pay off its debt, he and his lieutenants said.

SoftBank’s Vision Fund arm posted a $7.2 billion quarterly loss last week, driven by the falling value of portfolio companies including SenseTime Group Inc., DoorDash Inc. and GoTo Group. The company sold assets to raise cash and shore up its balance sheet and booked gains on the sale of part of its stake in Alibaba Group Holding Ltd.

“We need to fully focus on defense,” said Yoshimitsu Goto, SoftBank’s chief financial officer. “SoftBank is pessimistic about the prospects. We don’t see the light yet.”

The 65-year-old son owns 17.25% of a vehicle established under SoftBank’s Vision Fund 2 for his unlisted holdings, as well as 17.25% of a unit within his Latin America fund, which also invests in startups. He has a 33% interest in SB Northstar, a vehicle set up at the company for trading equities and derivatives.

Portfolio losses pushed Son’s deficit to about $2.8 billion from its stake in Vision Fund 2 and $252 million from the Latam fund, according to the September quarter disclosures. Its remaining deficit at SB Northstar was 233.6 billion yen ($1.6 billion). The amount Son owes SoftBank from its shares in Vision Fund 2 and the Latam Fund increased by about $750 million last quarter, according to Bloomberg calculations, which have been confirmed by SoftBank.

Son’s stakes in Vision Fund 2 and Latam Fund were structured in such a way that the billionaire did not prepay his 17.25% stake in cash. The son is required to pay 3% of the “unpaid equity purchase amount” pending repayment, interest that has been wrapped up in his debt.

There is no deadline for repayment and the value of Son’s positions could improve in the future and Son has already deposited cash and other assets for SB Northstar. The founder would pay its share of any “unfunded repayment obligations” at the end of the fund’s term, which runs for 12 years with a two-year extension.

Son has pledged 8.9 million of its own shares as collateral for the Vision Fund 2 and an additional 2.2 million shares as collateral for the Latam fund, the company said in its disclosures. The stock is not released until the receivables have been settled.

According to calculations by the Bloomberg Billionaires Index, Son’s net worth at the close on Thursday was $12.7 billion after adjusting for his deficit from his shares in Vision Fund 2 and Latam Fund.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.