Single-digit millionaires belong to the “middle class,” argues the real estate mogul

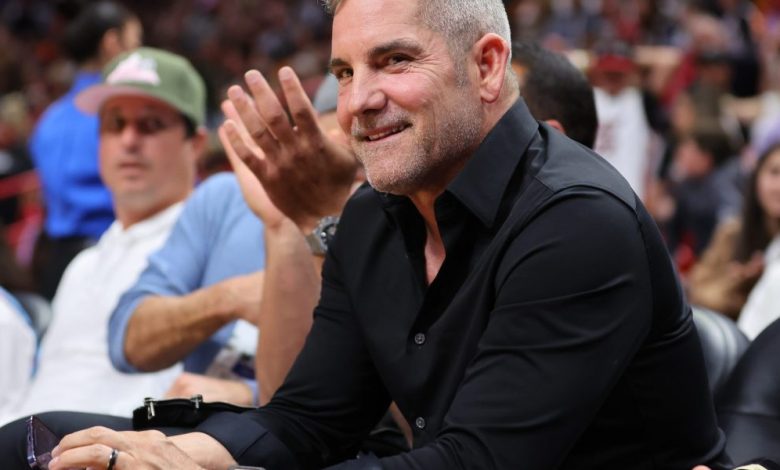

Being a millionaire may not hold the same cache as it used to. So argues real estate mogul Grant Cardone in a recent video on his YouTube channel, in which he describes five steps to becoming a millionaire.

“Everyone’s like, ‘Oh my god, the legendary millionaire, you’re rich,'” he said. “You’re not wealthy… you worry.”

In the video, Cardone stands in a desolate office and does a lot of yelling to show that these days, being a single-digit millionaire doesn’t get you very far (which, if you take his word for it, says a lot about the rest of us , considering the typical net worth of a family in the US is $121,700). He broke down some calculations to confirm his point: If a 30-year-old with $1 million and zero income spent $4,000 a month, which equates to $48,000 a year, he’d be broke by age 51.

“Millionaires are basically middle-class people who worry about money,” Cardone said.

The self-made millionaire, who is CEO of real estate investment firm Cardone Capital, author of several business books and a Scientologist, is known for his hot takes — he has said in the past he would be embarrassed if he only made $400,000 a year. And his polarizing comments don’t stop with money advice – for which he recently came under fire Tweets to his almost 1 million followers on anti-trans laws. Being controversial is one of his trademarks: As he recently tweeted: “You don’t have to like everything I say. The feeling is mutual.”

A lot of people might not like his take on single-digit millionaires either (Cardone didn’t respond Assets Request for comments). After all, making $1 million doesn’t happen overnight for most people. It’s a hard net worth if you’re in the actual middle class, which Pew Research Center defines as a single person making between $30,003 and $90,010, or a family of four making $60,000 to $180,000 to take home takes.

Now the hypothetical 30-year-old millionaire Cardone speaks does fall into this middle-class bracket if they live on $48,000 for the next 21 years. But the example is highly unlikely: most people don’t aspire to retire at that age unless you belong to a small subgroup that wants to join the FIRE movement and are the ones who do often relied on passive income, which Cardone didn’t account for.

A million dollars is pretty much out of reach for the average person; The average American household has a median of $5,300 in savings (the average, skewed by high earners, is slightly better at $41,600). While one’s wealth also includes assets like real estate and car ownership, these two investments have become less accessible to the middle class in recent years due to a combination of rising inflation, competitive markets and high interest rates.

While the middle class managed to save some money during the pandemic, their golden era has since faded as the economy recovered and 40 years of inflation hit. According to a Primerica poll, about 8 in 10 middle-class families in America say they’re pocketing their savings to keep up with the high cost of living. While many upper-class households got raises to keep up with inflation, middle-class families didn’t see the same pay rises — contributing to the already shrinking middle class.

Yes, the rich worry – but that doesn’t make them middle class

Sure, even the rich are feeling a little uncomfortable thanks to inflation and a rocky stock market. According to a survey by Edelman Financial Engines, less than half (44%) of millionaires feel “very comfortable” about their finances (although that’s still twice as many as all respondents). And 29% of millionaires say they don’t feel rich.

This is likely because today’s economy is having a negative impact on standard financial benchmarks; Consider that more than half of Americans who make over $100,000 a year feel like they’re living paycheck to paycheck. And $1 million isn’t always enough for a comfortable retirement anymore.

“While it is still an exceptional level of benefit, it is questionable whether this amount is sustainable as a lifetime source of income given improved longevity and high inflation,” said Michele Lee Fine, founder and CEO of Cornerstone Wealth Advisory Assets Alicia Adamczyk retires with $1 million.

But it can still be done with smart budgeting. “A million dollars isn’t what it used to be, but it can still provide a comfortable retirement if done right,” Gates Little, president and CEO of Southern Bank Company, told Adamczyk. Even if Cardone’s example above were applied to someone who retired at the full retirement age of 66, it would last them until they were 87 — perhaps not the full retirement age for some, but this example doesn’t include one either passive income or social benefits.

Of course, a single-digit millionaire means different things in different cities; In expensive cities like New York City or San Francisco, it probably won’t give someone as much financial security as in a non-metropolitan area. While Americans think it takes a net worth of $2.2 million to be wealthy, their standard for being financially comfortable – which could be equated with middle class – is $774,000.

But just because the value of $1 million has gone down in value doesn’t mean it’s not a lot of money, as Cardone suggests. A well-invested net worth of $1 million is nothing special.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.