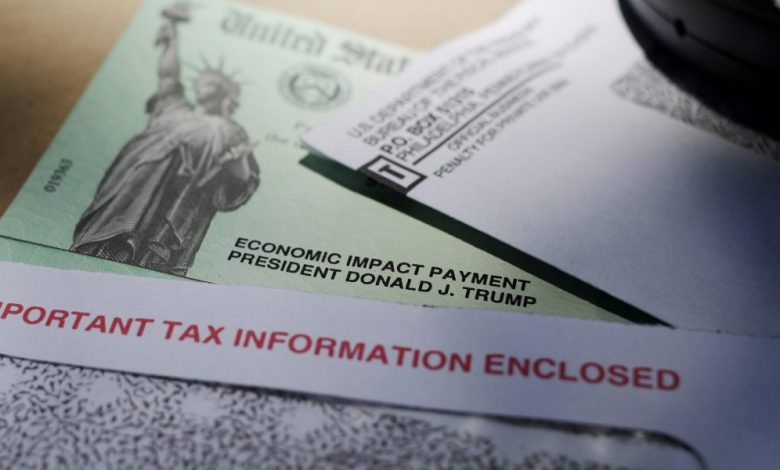

Most relief checks issued by states last year are not subject to federal taxes, IRS says after delay

The IRS announced Friday that most of the relief checks issued by states over the past year are not subject to federal taxes, providing guidance for the 11th hour when tax returns begin to flow.

A week after payees were asked to delay filing tax returns, the IRS said it would not challenge the tax liability of payments related to public welfare and disasters, meaning taxpayers who received those checks not have to pay federal taxes on these payments. Overall, the IRS said 2022 special payments were made by 21 states.

“The IRS appreciates the patience of taxpayers, tax professionals, software companies and state tax administrators while the IRS and Treasury Department have worked to resolve this unique and complex situation,” the IRS said in a statement Friday night.

The states that do not require taxpayers to report relief checks are California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania, and Rhode Iceland . So are energy relief payments in Alaska, which were in addition to the Permanent Fund’s annual dividend, the IRS said.

Additionally, many taxpayers in Georgia, Massachusetts, South Carolina and Virginia also avoid federal taxes on state payments if they meet certain requirements, the IRS said.

In California, most residents received a “middle-class tax refund” last year, a payment of up to $1,050 depending on their income, filing status and whether they had children. The Democrat-controlled state Legislature approved the payments to offset record high gas prices, which peaked at $6.44 a gallon in June, according to the AAA.

A key question was whether the federal government would count these payments as income and require Californians to pay taxes on them. Many California taxpayers had delayed filing their 2022 returns while awaiting a response. On Friday, the IRS said it would not tax the refund.

Maine was another example of states where the IRS stance had created confusion. As of Thursday, more than 100,000 tax returns had already been filed, many of them filed before the IRS asked residents to delay filing their returns.

Democratic Gov. Janet Mills last year pushed for $850 in pandemic relief checks for most Mainers to make ends meet as a budget surplus soared.

Her administration designed the aid program to comply with federal tax law to avoid subjecting it to federal taxes or being included in federally adjusted gross income calculations, said Sharon Huntley, spokeswoman for the Department of Administrative and Financial Services.

Senate President Troy Jackson called the confusion created by the IRS “harmful and irresponsible.”

“Democrats and Republicans have worked together to create a program that complies with federal tax laws and supports more than 800,000 Mainers,” the Allagash Democrat said in a statement Friday.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.