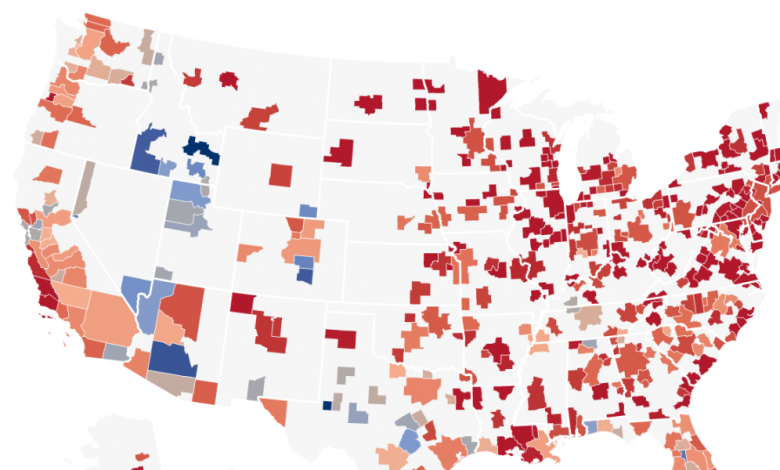

Morgan Stanley is lowering its outlook for the US housing market – where it sees the home price correction in 2023

Nationally, home prices fell 1.3% between June and August. This was the first decline as measured by the lagged Case-Shiller National Home Price Index since 2012.

It’s more than just a small dip, it’s a trajectory shift. At least that’s according to the latest forecast from Morgan Stanley’s economics team.

This year, Morgan Stanley expects US house prices, as measured by the Case-Shiller Index, to finish up 4% year-on-year. But considering that the Case-Shiller index is up 8.9% in the first six months of 2022, that means Morgan Stanley expects U.S. home prices to fall about 5% in the second half – including the 1.3% drop between June and August of 2022.

The home price correction won’t stop there. Morgan Stanley expects U.S. home prices, as measured by the Case-Shiller Index, to fall another 4% in 2023. Overall, the Wall Street Bank expects house prices to fall by around 10% between June 2022 and the 2024 bottom. (Previously , Morgan Stanley had predicted a 7% peak-to-trough decline in US home prices).

The last housing correction, which saw US home prices fall 27% between 2006 and 2012, was anchored by high unemployment, “pressed” affordability, dodgy mortgage products and a supply glut. This time we only have something wealth cites “pressurized” affordability: Seedy home prices coupled with spike mortgage rates.

“The median price of existing home sales is up 38% since March 2020. Mortgage rates are up over 300 basis points [3 percentage points] in the last eight months, the first time since 1980/81 that we have seen something like this. The combination of both has resulted in affordability deteriorating faster than at any time in our time series,” the Morgan Stanley researchers write.

Going forward, according to the bank, three levers can help “unburden” affordability. First, if inflation slows and financial conditions ease, that would theoretically lower mortgage rates, thereby improving affordability. Second, rising incomes (which are up 4.4% year-on-year) could improve affordability. Third, further falling home prices would help “unburden” affordability. As long as affordability remains “under pressure,” Morgan Stanley expects that third lever to be pulled.

“Up to this point we have focused on property forecasts through the end of 2023, but we do not believe that December 2023 will be the bottom for property prices. It is not groundbreaking to say that house price developments through 2024 and beyond are fraught with more than a little uncertainty,” the researchers write.

Let’s take a closer look at Morgan Stanley’s latest real estate prospects.

Tight inventories won’t stop home prices from falling – but it could create a floor

The ongoing affordability shock – surging home prices coupled with high mortgage rates – has created a demand crater. Year by year, Mortgage purchase applications fell by 40.7%. However, this has not translated into rising supply levels: Inventories in October were 37.6% below October 2019 levels.

“Conditions of supply are historically at odds [for] Rising home prices from here. If we have less than 6 months of total supply, annual home price growth has never turned negative over the next 6 months since this Case-Shiller index began in the late 1980s. We are currently at a supply of just 3.9 months,” write the Morgan Stanley researchers.

But this time could be different: The ongoing squeeze from affordability could see house prices fall even though inventories remain tight.

“The fact that we expect house prices to fall annually in March 2023, even as inventories are tight, reflects how unprecedented this affordability situation is in the US housing market,” writes Morgan Stanley. “While supply is not keeping home price growth to zero, we believe it is preventing the home price drop from becoming too large.”

cop case: House prices will stop falling in 2023

Morgan Stanley expects US home prices to fall 10% through 2024. However, there is one “bullish” case where the company believes that US home prices will not fall in 2023 and the peak-to-trough drop is about 5%.

There are two main pillars to Morgan Stanley’s “bull” case: tighter-than-expected inventories and lower-than-expected mortgage rates.

“In a bull case, the lock-in effect keeps inventories at the lows we’ve seen over the past year. At the same time, lower mortgage rates are encouraging stronger buying demand than we currently expect, as households view any rally as potentially temporary. Take it easy and take advantage before taking the next step up,” Morgan Stanley researchers write.

In 2023, Morgan Stanley expects interest rates on 30-year fixed-rate mortgages to average 6.2%. However, if the Fed manages to tame inflation sooner than expected, easier financial conditions could see mortgage rates fall below 6%. If the so-called lock-in effect (i.e., homeowners not wanting to sell because they don’t want to give up their 2% or 3% mortgage rate) continues into 2023, it could further reduce inventories, Morgan Stanley expects at the moment.

bear case: Real estate prices collapse by 20%

If a “deep” recession materializes, Morgan Stanley forecasts that U.S. home prices could plummet by 20% from peak to trough — including a fall in home prices of up to 8% in 2023 alone.

“A common scenario we’re presented with when we talk about the bear market for housing prices is a longer and deeper recession leading to a significant increase in unemployment,” the Morgan Stanley researchers write. “What we think would be a more likely cause of a housing price bear fall would be an intersection of weaker-than-expected demand with a larger-than-current forecast rise in inventories.”

But even if this “bearish” scenario were to materialize, Morgan Stanley doesn’t believe it would be a full-blown repeat of the 2008 crash.

“During this [our bear case] understandably negative for the housing market, we continue to believe that the health of credit standards should cap how high genuine non-performing transactions can go. Additionally, a mortgage services industry that is far more proficient in offering foreclosure alternatives (e.g., amendments) to borrowers should keep more borrowers in their homes rather than forcing liquidation,” the Morgan Stanley researchers write.

Would you like to be kept up to date on the apartment correction? Follow me on Twitter at @NewsLambert.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.