KPMG: Pandemic housing bubble bursts – US home prices fall 15%, looks ‘conservative’

It didn’t take long for 2020 workers to realize that expanded work-from-home policies meant they could buy property virtually anywhere. Holiday markets went gangbuster. Outskirts were getting hot, as were so-called “Zoom cities” like Boise. Even large cities that were losing residents, like New York and San Francisco, became overheated as the decoupling of roommates triggered a spillover effect from the rental market to the housing market

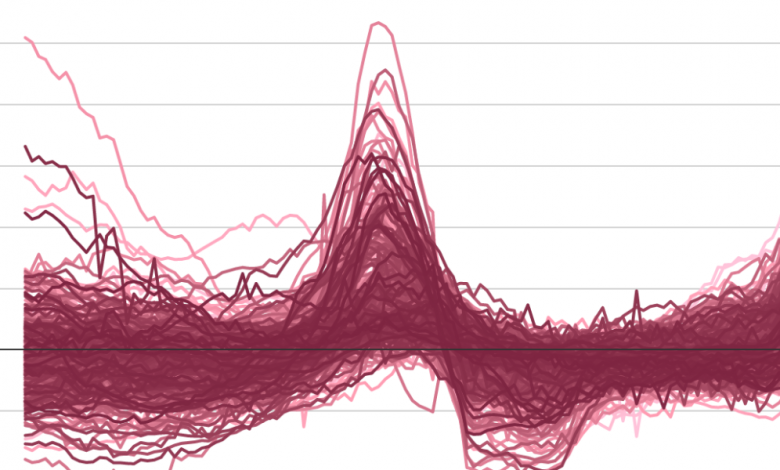

This pandemic housing boom coincided with a stunning 42% surge in US home prices between March 2020 and June 2022. At least 60% of that increase in value, researchers at the Federal Reserve Bank of San Francisco estimate, is due to the increased demand for “space” that occurred during the pandemic.

Of course, this demand boom hasn’t just fizzled out — it’s doing a 180-degree increase: YoY Mortgage purchase applications are down 41%. There are actually fewer requests to buy now than at the end of the 2008 crash.

This rapid fall in demand has also prompted more economists to utter the most feared word in housing: bubble.

“It was a pandemic [housing] Bubble fueled by work-from-home migration trends: high-wage workers moving to lower-middle second-tier markets for more space,” said Diane Swonk, chief economist at KPMG. “We went to extremes at WFH [spurred housing demand], but it ended rather abruptly. That’s one of the reasons why I think you’re seeing house prices fall too. Local incomes do not support many of these home values.”

We’ve already seen home price growth roll over nationally. Between June and August, the Case-Shiller National Home Index showed a 1.3% decline in US home prices. This is the first decline since 2012.

“Once prices drop nationwide, there’s a self-fulfilling dynamic because nobody wants to catch a falling knife,” says Swonk. “We will easily see large double-digit declines. I think 15% next year is very conservative. We’re already shooting.”

When wealth coined the term Pandemic Housing Boom, we did so knowing that if the boom ended in bust, we would have to rename it a Pandemic Housing Bubble. We even set a criterion for it: any market that shows a decline of more than 10% from peak to trough gets the Pandemic Housing Bubble label. Should KPMG’s prediction come true, the entire country would receive our Bubble label.

Here are the four big takeaways wealth‘s chat with Swonk.

High mortgage interest rates burst the “bubble”.

Whenever the Federal Reserve switches to rate-hike mode, it will pose problems for rate-sensitive sectors like the US housing market. When those rate hikes become aggressive because the central bank has fallen behind in its inflation fight, it gets much more intense.

Of course, that’s exactly what we saw in 2022. The Fed’s monetary tightening has caused the average 30-year fixed-rate mortgage rate to rise from 2.98% to 7.1% over the past year. This is the biggest mortgage rate shock since Fed Chairman Paul Volcker’s infamous tightening in 1981.

This mortgage rate shock is important for two reasons. First, historically low mortgage rates — which also helped fuel the pandemic housing boom — are gone. Second, the rise means many potential buyers have either been overpriced or lost their mortgage altogether.

House prices are falling – but that’s not the story of 2008

If US house prices do fall by 15%, it would be the second largest correction in house prices since World War II. Only the 27% correction between 2006 and 2012 would make it beat.

However, the Federal Reserve says this is not a repeat of the 2008 crisis.

“From a financial stability perspective, we haven’t seen the types of bad underwriting credit this cycle that we saw before the Great Financial Crisis. Home loans have been managed much more carefully by lenders. It’s a completely different situation [in 2022]it offers no potential [well] there do not seem to be any problems with financial stability. But we understand that [housing] There’s a very big effect of our policy here,” Fed Chair Jerome Powell told reporters earlier this month.

Swonk agrees with Powell: “This isn’t a subprime crisis, it is [the fed] right about that.”

While improved lending standards and tight supply should prevent a repeat of 2008, they are not enough to prevent a real estate correction. At least that’s how Swonk sees it.

“What’s interesting to me is how quickly some of these markets are correcting with inventory still very tight,” says Swonk.

Phoenix is very lively – Chicago not so much

As wealth As previously mentioned, the textbook definition of a real estate bubble requires three things. First, you would see an exuberant demand – fueled by speculation – pouring into the housing market. Second, property prices are rising well beyond what incomes can support, reaching “overvaluation” levels. Third, the real estate bubble bursts and real estate prices fall.

The pandemic housing boom brought “investor mania” back to the market. Historically low mortgage rates attracted comers and Airbnb hosts alike. Short-term fins, lured by record levels of house price increases, also jumped in. In fact, according to ATTOM data, a total of 114,706 houses were “flipped” in the first quarter of 2022. That’s more than any quarter in the years leading up to the 2008 bubble. Speculation? Check.

Moody’s Analytics calculates an “overvalued” or “undervalued” number for around 400 markets every quarter. The company wants to find out if fundamentals, including local income levels, could support local property prices. It’s only worrying when a housing market is significantly “overvalued”. In the second quarter of 2022, the typical market was “overvalued” by 23%. That’s up from 3% in Q2 2019 and up from 14% in Q2 2006. Overvalued? Check.

While the first two elements of the housing bubble have indeed returned during the pandemic, the third element has yet to hit. Swonk says “Burst” is starting, but it will vary by market.

The reason Swonk thinks the bust will vary? Some markets got a lot more bubbly than others.

For example, look at Chicago and Phoenix. Last time, both markets boomed and busted. It’s easy to see why, given that Chicago and Phoenix were “overvalued” by 32% and 48%, respectively, in 2006. This time around, however, Phoenix (which is now 54% “overvalued”) has seen a rush of out-of-town speculators and buyers, while Chicago (which is now 3% “overvalued”) has remained relatively tame.

Looking ahead, real estate economists expect markets like Phoenix to be at greater risk of sharper home price declines. In fact, Moody’s Analytics is currently forecasting a 18.7% drop in the bubbling Phoenix from peak to bottom. In Chicago, the analytics firm expects house prices to fall just 3.6%. (Moody’s forecasts for 322 markets can be found here).

Falling home prices help the Fed

Fed Chairman Jerome Powell has made it clear that the US housing market is in a “difficult correction”. Once it is complete, buyers and sellers alike will return to a “reset” market.

Some economists read between the lines and take “reset” to mean “home prices will fall.”

“Let’s be honest, where is one of the biggest drivers of inflation right now? It is the cost of accommodation. And there they are [the Fed] have the most power,” says Swonk. “And so, yes, it was a stunning climb [home] Prices. An unsustainable rise – some kind of correction is needed. The problem is that you don’t get to choose how big that correction is.”

A slight correction in house prices, Swonk says, would help the Fed contain both housing costs and headline inflation. In this scenario, buyers could return to a market with lower prices, more inventory, and lower mortgage rates.

Hungry for more apartment data? Follow me on Twitter at @NewsLambert.