Investors buy half as many houses

Imagine you are outbid by a company for a single family home. That’s been all too real in recent years, as investor home purchases soared, fueling the pandemic housing boom and driving many aspiring home buyers out of the market.

Over the past year, the average interest rate on 30-year fixed-rate mortgages has risen to over 7%. The year before, mortgage rates were at historic lows and demand was high, fueling investor frenzy in the housing market. Real estate agent Redfin’s new report shows how big the difference in investor home buying is between the two years.

In the fourth quarter of 2022, investor home purchases fell 45.8% compared to the same period last year as mortgage rates rose and home prices fell, Redfin researchers wrote. To add some perspective, the 2008 housing crisis saw a slightly smaller decline, with investor purchases falling 45.1%.

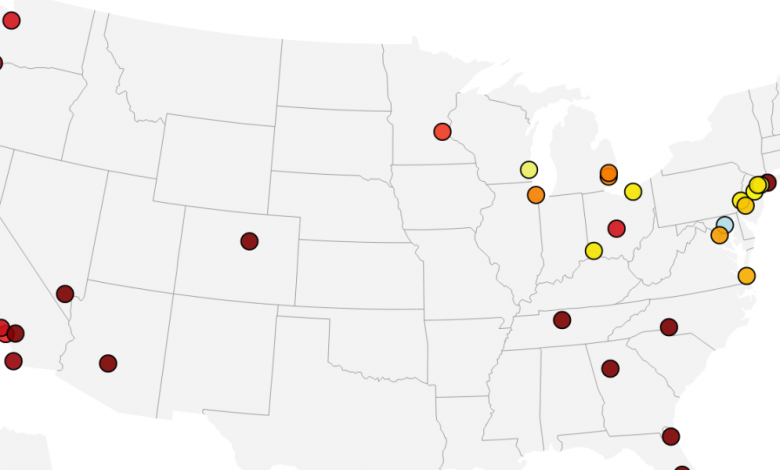

For this report, researchers analyzed county records in 40 metropolitan areas in the United States and defined “investor” as any institution or company that buys residential real estate.

“Investors rushed into the housing market in 2021 on the back of mortgage rate lows and rising demand for housing, and are now pulling back amid projections that house prices have room to decline,” the report said.

Pandemic boomtowns like Las Vegas and Phoenix are already seeing sharp corrections. In Las Vegas, home purchases by investors fell 67% year over year in the fourth quarter of last year, which the Redfin researchers identified as the largest drop among the 40 metro areas they studied.

Phoenix posted a 66.7% decline over the same period. Meanwhile, Nassau County saw a 63% drop, Atlanta a 62.8% drop and Charlotte a 61.9% drop. All of this made up the top half of the 10 biggest declines Redfin has reported. The other half included, according to the report: Jacksonville (down 57.1% in Q4 2022 year-on-year), Nashville (-54.8%), Sacramento (-53.5%), Riverside (-53.0%) and Orlando (-51.8%).

Some of the smallest falls of less than 10% were seen in Milwaukee, New York and Providence. Meanwhile, Baltimore was the only major city analyzed by Redfin with a 1.4% increase in investor home purchases.

Interestingly, what exactly investors are buying has also changed. Redfin researchers found that investor purchases of single-family homes fell 49.8% year over year in the fourth quarter of 2022. The decline is the largest of any other property type. For example, investor condo purchases fell 35.6% and multi-family home purchases fell 31.1%. But despite the biggest drop, single-family homes are still the most popular choice among investors.

And homebuyers are tightening their wallets, with high- and mid-range home purchases down more than 50%. According to the report, investor buying at bargain prices fell by 28.6%.

However, mortgage rates have come down slightly this year and some markets are seeing a pick-up in activity as the peak season begins, which could pique investor interest.

“Investors may return to the market this year as mortgage rates have fallen from their 2022 high — especially if house prices show signs of bottoming out,” said Sheharyar Bokhari, senior economist and researcher at Redfin for the report . “But investors are unlikely to come back with the same force that they had in 2021.”

And that could actually be good news for individual buyers, Bokhari added, as they may no longer lose bidding wars against investors.

Where will US home prices go next? Here are the individual forecasts from 29 leading real estate research firms.

Goldman Sachs just made a bold call to action on the housing market – here it is

How house prices are expected to change in over 300 real estate markets, according to updated forecasts from Zillow and Moody’s

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.