Housing market correction wipes out $2.3 trillion in value

For 124 straight months, from the bottom of the housing crash in February 2012 to the peak of the pandemic housing boom in June 2022, US home prices posted positive month-on-month growth. This phase, of course, came to an abrupt end last year when the Fed’s inflationary war triggered a correction in house prices.

On the one hand, national home prices have fallen only a few percentage points from their peak through November, according to the seasonally adjusted Case-Shiller National Home Price Index. On the other hand, the ongoing housing correction is already beginning to have a financial and psychological impact on homeowners.

On Wednesday, Redfin released a report that found the total value of US homes has fallen by $2.3 trillion since the home price correction began.

“The total value of US homes at the end of 2022 was $45.3 trillion, down 4.9% ($2.3 trillion) from a record high of $47.7 trillion in June is equivalent to. This is the largest percentage drop from June to December since 2008,” write Redfin researchers.

To be clear, while a home price correction is certainly taking place in many markets across the country, most homeowners are still coming strong since the pandemic began.

“The housing market has depreciated somewhat, but most homeowners will still reap big rewards from the pandemic housing boom,” Redfin researchers said in the report. “The total value of US homes remains approximately $13 trillion higher than it was in February 2020, the month before the coronavirus was declared a pandemic.”

Is this house price correction almost over? It depends who you ask.

among the 29 major real estate forecastersSix companies expect national house prices to either increase or remain flat in 2023. Meanwhile, 23 major real estate forecasters expect national house prices to fall further this year.

Fed officials have admitted they are paying close attention to the correction.

Minutes from the most recent FOMC meeting released Wednesday showed Federal Reserve officials believe that “valuations in both the residential and commercial property markets have remained elevated” and “that the potential for a sharp decline in home prices is greater than usual.” has remained”.

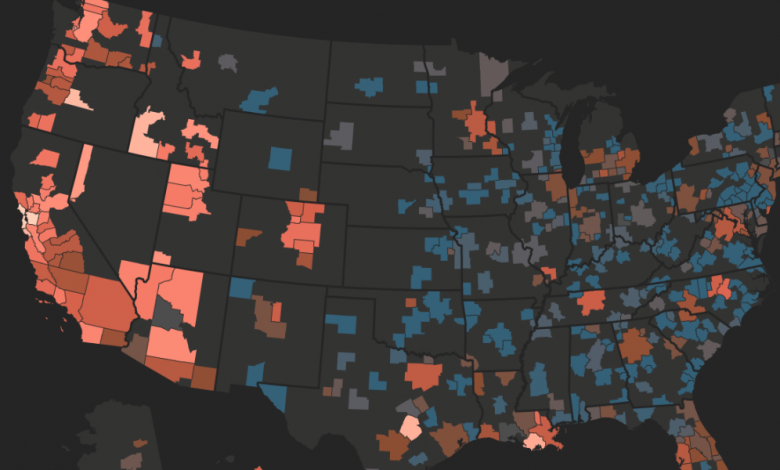

Whenever a group like Redfin says “US home prices,” they mean a national aggregate. At the regional level, this home price correction (or lack thereof) continues to vary.

Among the nation’s 400 largest housing markets tracked by Zillow, 276 saw local home prices decline from their seasonally adjusted 2022 peak. Another 124 markets remain at their 2022 peak.

The markets with the biggest declines including places like Bend, Ore. (down 9.2%) and Phoenix (down 6.3%), are disproportionately located on the Pacific Coast and Southwest.

Going forward, Goldman Sachs expects this gap between West and East to continue.

“On a regional basis, we project larger declines in the Pacific Coast and Southwest regions — which on average have seen the largest inventory increases — and more modest declines in the Mid-Atlantic and Midwest — which have maintained greater affordability over the past few years,” Goldman Sachs wrote recently in a report.

Would you like to be kept up to date on the apartment correction? Follow me on Twitter at @NewsLambert.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.