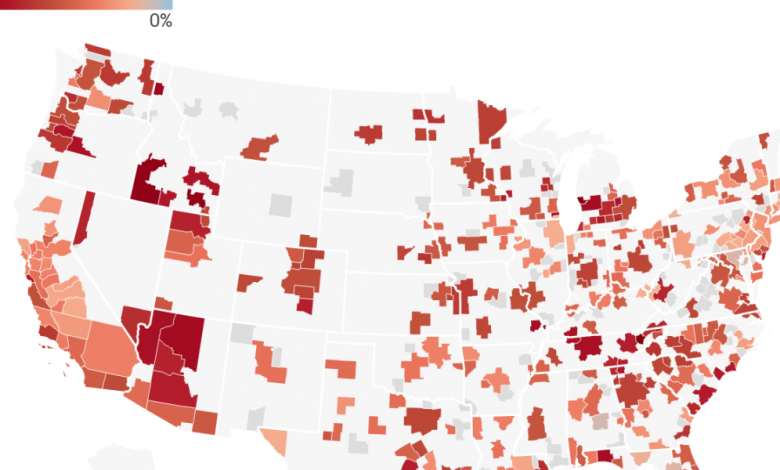

Home prices are down over 15% in these 49 property markets – this interactive map shows Moody’s updated forecast for 322 markets

A historic mortgage rate shock — with the average rate on 30-year fixed-rate mortgages jumping from 3% to 6% this year — after the 41.3% surge in U.S. home prices from the pandemic housing boom in just over two years has left many Prospects are simply made to be buyers to their breaking point. Other borrowers, who must meet lenders’ strict debt-to-income ratios, have lost eligibility for mortgages altogether. That historical pressure that comes from prices and rates is what wealth calls “pressurized affordability”.

Pressured affordability has already caused US home prices, as measured by the Case-Shiller National Home Price Index, to fall in seasonally adjusted terms for the first time since 2012. Overall, US house prices fell by 2.2% between June 2022 and September 2022, marking the second largest post-war house price correction.

Whenever a release like wealth “US House Prices” says we are talking about a national aggregate. Whatever comes next in the US housing market will certainly vary by market, price point and home type.

To get an idea of what could come next wealth has again reached out to Moody’s Analytics for their updated home price forecast (see map below) for 322 of the country’s largest property markets. (Here’s their previous tube-by-tube prediction).

Here’s what the data says.

Back in May, Mark Zandi, chief economist at Moody’s Analytics, said wealth that the Federal Reserve’s inflationary war would cause the US housing market to slide into a “housing correction.” At the time, he expected house prices to stagnate nationwide, falling between 5% and 10% in “significantly overvalued” markets.

Of course, Zandi was right about the apartment correction. In fact, the correction was so sharp that in October Moody’s Analytics again lowered its outlook for national home prices. From peak to trough, Zandi expects US home prices to fall 10%. If a recession materializes, that outlook shifts to a 20% decline from peak to trough.

“No change in our outlook for [national] real estate prices or mortgage rates. I’m more confident that the economy can avoid a full-blown recession next year, consistent with the 10 percent peak-to-valley decline in national house prices,” Zandi said wealth on Friday. By the spring of 2023, he expects mortgage interest rates to be around 6.5%.

While Zandi expects peak-to-trough home price declines of about 10% nationwide, he expects it to vary regionally. In markets like Morristown, Tennessee and Muskegon, Michigan, Moody’s Analytics is forecasting a 24.1% and 23.3% decline in home prices, respectively. The company expects markets like New York and Chicago to fall 6.3% and 4.2% from peak to bottom, respectively.

Looking ahead, Moody’s Analytics expects “clearly overvalued” housing markets to post the sharpest declines. (Moody’s market related overvaluation study can be found here).

Look no further than markets like Boise and Flagstaff, Arizona. Just weeks into the pandemic, these markets were flooded with buyer interest from white-collar workers working in high-wage cities like Seattle and San Francisco. While remote work was a game changer for these uprooted employees, it did not fundamentally change local incomes. As the boom continued, Boise and Flagstaff were “overvalued” by 76.9% and 65.6%, respectively.

Fast forward to 2022, and slowing migration means these boomtowns will have to rely more on local income. That will be difficult, says Zandi. That’s why Moody’s forecasting model expects house prices in markets like Boise and Flagstaff to fall by over 20% from peak to trough.

Speaking Tuesday at a Brookings Institute event, Fed Chair Jerome Powell said the rise in house prices during the pandemic housing boom qualifies for a “housing bubble.”

“After the pandemic [mortgage] Interest rates were very low, people wanted to buy houses, they wanted to get out of the cities because of COVID and buy houses in the suburbs. So you really had a real estate bubble, you had real estate prices rising [at] very unsustainable levels and overheating and stuff like that,” Powell said. “So now the housing market is going to go through the other side of that and hopefully come out in a better spot between supply and demand.”

Indeed, the pandemic housing boom has thrown the fundamentals of housing construction out of whack. According to Moody’s Analytics, the average US housing market was “overvalued” by 1% in the second quarter of 2019. By the second quarter of 2022, the average US housing market was “overvalued” by around 25%.

Going forward, Zandi doesn’t expect a 2008-style financial crisis or foreclosure crisis, but he does expect real estate market fundamentals to move back toward the mean. Part of that moderation will come from rising incomes, part of it from falling house prices.

“Before [home] Prices started to go down, we were overpriced [nationally] by around 25%. That means now [home] Prices will normalize. Affordability is restored. That [housing] The market will not be overvalued once this process is complete,” says Zandi. “It’s all about affordability. First-time buyers are excluded from the market. They just can’t afford mortgage payments. Trade-up buyers won’t sell and buy because it doesn’t make commercial sense.”

Of course, the home price correction has already arrived.

Just over half of the country’s 400 largest housing markets have seen local home values, as measured by Zillow, fall below their 2022 peak. The average drop is -2%.

The ongoing correction has hit two different types of markets hardest: high-price West Coast markets and “bubbly” boomtowns.

Even before the correction was fully underway, John Burns Real Estate Consulting said wealth that the high-cost West Coast markets were at greater risk of downside. The reason for this is that they are simply more rate sensitive. Markets like Seattle (down 6.3%) and Portland, Oregon (down 5.1%) are taking a double hit: Not only are their high-end housing markets more interest rate sensitive, but so are their technology sectors. Add to that the fact that homebuilders and iBuyers – who are more likely to cut prices during a correction – account for a higher inventory concentration outside the West.

The other group of markets that have been hit hard by the correction are bubbly markets. These markets, which include places like Austin (down 10.2%) and Boise (down 7.1%), saw their home values detach from underlying fundamentals (ie local incomes) during the boom. And now they are seeing sharper pullbacks.

Would you like to be kept up to date on the apartment correction? Follow me on Twitter at @NewsLambert.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.