For this reason, billionaire investor David Tepper is investing in stocks in 2023

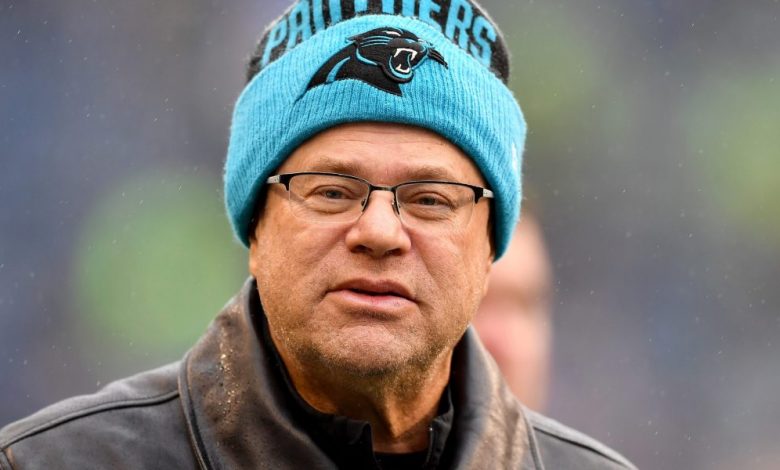

Today, David Tepper is probably best known as the owner of the NFL’s Carolina Panthers. But before his time in the owners’ suite, the billionaire made his mark as a hedge fund titan.

Tepper founded Appaloosa Management in 1993 after honing his skills as a credit analyst at Goldman Sachs and is known for taking risky bets when others are afraid. Appaloosa famously made $7 billion by gobbling up run-down bank stocks in the wake of the Great Financial Crisis in 2009.

But on Thursday, Tepper – who said he still considers himself an “optimist” – revealed he was betting against the stock market. The hedge fund said central banks will continue to raise interest rates to fight inflation, and that’s bad news for stock prices.

“So I’d probably say I’m short the stock markets,” he told CNBC, referring to short selling. “Because I think the ebb and flow just doesn’t make sense to me with so many central banks telling me what they’re going to do.”

Many central banks around the world have been aggressively raising interest rates in 2022 in hopes of taming global inflation, which has risen to 8.8% today from 3.2% in early 2020, according to the International Monetary Fund.

In the US, the Federal Reserve has hiked interest rates seven times this year, for a total increase of 4.25% — the highest one-year rate since 1980.

Tepper said that despite the chorus of critics arguing that central banks should slow or suspend rate hikes, he believes officials will remain focused on fighting inflation.

“You have to believe them,” he said. “I think they’re concerned about the inflation rate, which is going to be stubbornly 3.5%, 3.75%, 4%.”

A number of Wall Street leaders have expressed concern that inflation may not fall to central banks’ 2% targets next year. Mohamed El-Erian, President of Queens’ College at the University of Cambridge, said last month that inflation could be “stuck” at uncomfortably high levels due to rising wages, supply chain problems and a “change in globalisation”.

In this environment of rising interest rates, Tepper questioned whether the S&P 500 was trading at a meaningful earnings multiple.

Earnings multiples, or price-to-earnings ratios, are a way for investors to value stocks — or in this case, an index like the S&P 500 — based on company earnings. And since rising interest rates can weigh on earnings, periods of higher interest rates tend to have lower earnings multiples for stocks.

“Why are we still betting these high multipliers like we did when I had 1% rates? I need to get several realistic ones out there,” Tepper said Thursday.

Today, the S&P 500 trades at about 17.8 times 3,800 earnings, but Tepper noted that the index could fall to 3,600 if that number declined even slightly to 16 times in the coming year.

The market will have to decide what the right earnings multiple should be for this new economic era, but if history is any guide, things could get worse.

But Tepper pointed out that the S&P 500 was trading at about 12 times earnings in 2010 when interest rates were near zero following the Great Financial Crisis of 2008. So, at today’s interest rates, there is potential for the index’s current multiple to fall sharply.

“So that’s just the question of the stock market. What should the multiple be?” Tepper said.

And as the Federal Reserve continues to raise interest rates, stocks also face another risk.

“You [the Federal Reserve] I can’t say, but maybe there will be some kind of small recession,” Tepper said.

Our new weekly Impact Report newsletter explores how ESG news and trends are shaping the roles and responsibilities of today’s leaders. Subscribe here.