Disney is asking shareholders to discard Nelson Peltz’s ballots

Disney on Thursday made clear what it thinks of Nelson Peltz and his direct appeal to shareholders to elect the activist investor to the board.

Throw it straight into the trash can.

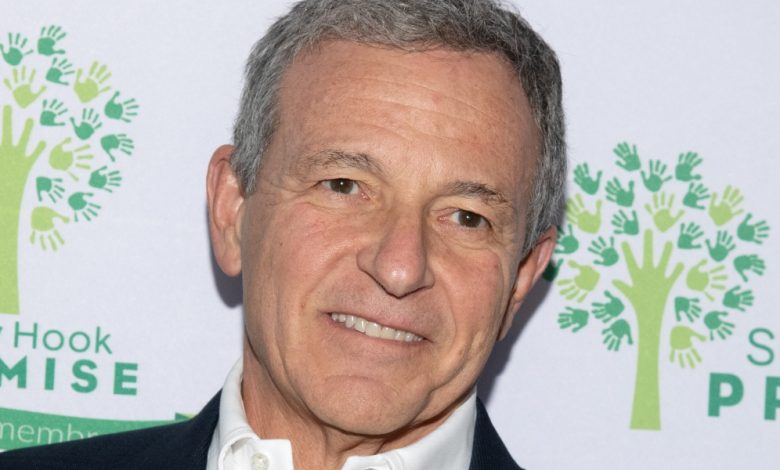

The House of Mouse, which has been under the leadership of returning CEO Bob Iger since November, said granting Trian Fund Management co-founder a seat at the table threatens to undermine the company’s overall strategy at a sensitive juncture and must be stopped.

“We are skeptical of his motives and believe he would be disruptive at a crucial time for Disney,” it argued in a statement. “In fact, Mr. Peltz sought a seat on the board of directors before he was a shareholder.”

This could be a possible clue to the investor’s friendship with Ike Perlmutter, a major Disney shareholder since he sold Marvel to the company in 2009. The two billionaires live in Palm Beach, Florida, and supported Donald Trump, a critic of the media company and its forward-thinking employees.

Perlmutter’s relations with the media giant were strained, particularly after Iger complied with Marvel Studios CEO Kevin Feige’s desire to be free of Perlmutter’s constant interference.

Accordingly Hollywood reporter, Peltz, with Perlmutter’s support, held talks with then-Disney CEO Bob Chapek last July. But any plans they might have hatched together are believed to have been scrapped after Chapek’s sudden fall one weekend in late November.

Disney doesn’t want shareholders to vote until management comes up with a new strategic plan

On Thursday, Disney’s board of directors told shareholders they didn’t need someone like Peltz to advocate for them, as their interests would be adequately represented by no fewer than 10 out of 11 board members regardless of the day-to-day leadership team led by Iger.

She called on shareholders to therefore support the re-election of former US Trade Representative Michael Froman to the board and to vote against his investment firm’s nomination of Peltz.

“Froman’s decades of experience in business and international affairs are critical in helping Disney assess the risks and opportunities in an increasingly complex global marketplace,” the company wrote.

A recent deal may underscore this point. Disney recently secured regulatory approval from Beijing Black Panther: Wakanda Forever to China starting next week, ending a ban that had been in place since July 2019 – before the pandemic broke out.

The board therefore asked investors to wait until he could begin mailing materials for his not yet scheduled AGM, including his white proxy card with Froman on the ballot.

By then, management might be able to present investors with its case for how it would grow the company going forward.

“Shareholders should take advantage of voting on a fully informed basis and consider the important update from the board and management team on its strategy to create value,” he argued. “If you have already received any materials with a blue power of attorney card from Trian Group, please simply discard them.”

Trian Fund Management, which claims to own $1 billion in Disney stock, didn’t immediately respond to a request from wealth for comment.

Peltz argues Disney is a ‘company in crisis’

Peltz is no stranger to shareholder showdowns and has not been one to back down before a fight.

The Floridian is a veteran of three separate proxy wars that pitted management against investors: first with Heinz in 2006, then with DuPont in 2015, and finally with Procter & Gamble two years later.

Trian argues that Disney is a “troubled company” whose problems are “largely self-inflicted,” resulting in a loss of over $120 billion in market cap over the past year that has sent the stock to eight-year lows.

It slams everything from excessive management pay and overpayments for Twenty-First Century Fox’s traditional media assets to a flawed streaming strategy that led to its first dividend suspension in 57 years.

Importantly, Trian claimed it would not favor financial engineering by piling on Disney’s debt-ridden balance sheet at the risk of reduced solvency — a common demand of short-term activist investors — nor did it attempt to wind up the company or replace Iger as CEO.

However, Disney doesn’t play along, arguing that its rejection of Peltz is based on over six months of conversations and written exchanges with the Trian co-founder.

“He has shown he does not understand Disney’s businesses and lacks the perspective and experience to contribute to the goal of delivering shareholder value in a rapidly changing media ecosystem,” it told shareholders Thursday.

Disney will release its first-quarter results after the close on February 8ththwith all eyes on the direct-to-consumer division in charge of the streaming business.

CFO Christine McCarthy promised in early November that three-month DTC losses peaked at nearly $1.5 billion in the fourth quarter and should have narrowed by at least $200 million in the first quarter.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.