COP 27: African Development Bank Group and EBRD reaffirm commitment to climate adaptation and helping African businesses become more resilient | African Development Bank

Diplomat.Today

The African Development Bank

2022-11-30 00:00:00

——————————————-

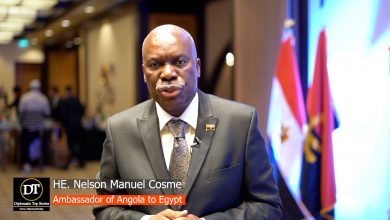

Dr. Akinwumi Adesina, President of the African Development Bank, and Odile Reinaud-Basso, President of the European Bank for Reconstruction and Development (EBRD), have agreed that their organizations will step up cooperation to increase the resilience of African companies. The two heads of development banks spoke at this year’s global climate summit (COP27) in Egypt’s Sharm El Sheikh earlier this month.

Adesina stressed that “climate adaptation in Africa was a key condition for sustaining economic growth and maintaining social cohesion on the continent.”

Reinaud-Basso confirmed the EBRD’s commitment to support the implementation of the Africa Adaptation Acceleration Program (AAAP), an initiative jointly launched in 2021 by the African Development Bank and the Global Center on Adaptation. The program will mobilize $25 billion by 2025. These funds will help accelerate climate adaptation action in Africa through initiatives in four priority areas: food security; resilient infrastructure; youth entrepreneurship and job creation; and innovative financing for climate adaptation.

Global warming is bringing about a rethink of how infrastructure, cities and financial systems are designed and managed. This requires effective partnerships between public and private actors and strong involvement of civil society.

By collaborating and working closely with government agencies, public utilities, local businesses and communities, multilateral development banks such as the African Development Bank and the EBRD can play a catalytic role in developing the financing approaches that support this transformation, as financing models leverage both public and private channels.

Multilateral development banks can also support the development of innovative financing products by using blended finance approaches and by developing market-based instruments that reward companies that invest in climate resilience projects. Both institutions will work together to further develop that of the African Development Bank Adaptation Benefits Mechanism. They will explore innovative non-market approaches under Article 6.8 of the Paris Agreement.

The African Development Bank and the EBRD will expand their cooperation in all these areas under the Africa Accelerated Adaptation Programme. They will prioritize supporting countries and customers to understand physical climate risks and scale adaptation investments.

Reinaud-Basso said: “Africa has the potential to become a global leader in climate adaptation solutions and services and we want to expand our collaboration to help Africa realize its potential.

Adesina said he and his EBRD counterpart were both in full agreement that multilateral development banks need to adapt their business models to respond to the many crises they face, including climate change and the task of building resilient economies.

“While maintaining their triple-A rating, which should remain the cornerstone of the business model of multilateral development banks, MDBs must find ways to secure more venture capital to drive more private sector investment,” said Adesina. He added: “One of those near term is the reallocation of some of their special drawing rights from the International Monetary Fund from rich countries to MDBs. These can apply a multiplier of 3 to 4 to it. Both the African Development Bank and the EBRD are ready to implement this option, which will provide great value for money for the countries that will provide SDRs.”

——————————————-