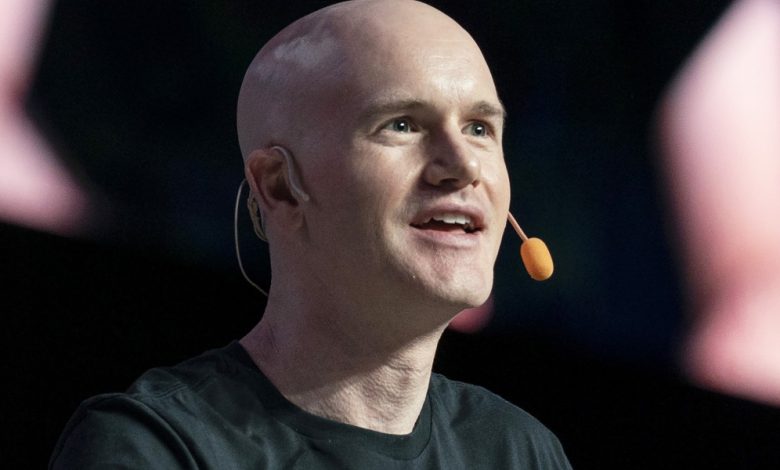

Coinbase CEO Brian Armstrong believes his company’s revenue will fall by at least another 50%

Coinbase Global Inc. Chief Executive Officer Brian Armstrong said the cryptocurrency exchange’s earnings will fall by half or more this year as falling prices and the collapse of rival FTX shake investor confidence.

FTX’s rapid demise capped an already brutal year for the cryptocurrency industry, with speculators retreating as the prices of some of the most commonly traded tokens fell. Coinbase’s shares are down more than 80% in 2022, and the company’s third-quarter revenue was about a quarter of what it was in the last three months of 2021, when Bitcoin’s price was at its peak.

“Last year in 2021 we had about $7 billion in revenue and about $4 billion in positive EBITDA, and this year is looking at about half that or less with everything going down out,” Armstrong told a wide-ranging interview on Bloomberg’s “David Rubenstein Show: Peer-to-Peer Conversations” when asked about the company’s earnings. In additional comments after the interview, a Coinbase spokesperson further clarified that they expect less revenue in 2022 half of sales in 2021.

Coinbase has previously indicated that it could see a loss of no more than $500 million in 2022 based on adjusted EBITDA, an earnings measure that excludes certain costs such as interest and depreciation. The company didn’t previously provide guidance for total sales for the full year, but Armstrong’s estimate matches what analysts were expecting to be around $3.2 billion, according to data compiled by Bloomberg.

The turmoil surrounding FTX deepened the veil hanging over the industry, with confidence already battered by the previous bankruptcy of lender Celsius Network. Another lender, BlockFi Inc., went bankrupt last month, citing issues related to FTX’s collapse.

Armstrong said the demise of Sam Bankman-Fried’s FTX appeared to be the result of “massive fraud” rather than mismanagement or accounting errors, as Bankman-Fried has conveyed in interviews since the bankruptcy. Bankman-Fried has not been charged with any wrongdoing.

“It seems they took client money off their exchange and actually mixed it up or moved it to their hedge fund and then ended up in a very bad position,” Armstrong said. “And that, I believe, was against their terms of service and against the law.”

Prior to his ouster, Bankman-Fried promoted crypto-friendly policies during his frequent visits to Washington, DC and was a major contributor to congressional races.

“I think there are some really serious questions that need to be asked now if some of that money should be recovered because it appears it was stolen from customers,” Armstrong said.

Despite the impact of FTX, Armstrong said he plans to continue lobbying the industry on Capitol Hill and predicted crypto-specific legislation could still be enacted over the next year. Regulations around stablecoins, centralized exchanges and custodians, as well as clarity on how commodities and securities are defined should be a priority, he said.

“I would say there’s still probably 20% of Congress that is either very hostile to this or just doesn’t know, but it’s not the majority view at this point,” he said of cryptocurrencies. “We can hopefully get something there in the US and then go for the rest of the G20 as well.”

For more details from Coinbase CEO Brian Armstrong, see “The David Rubenstein Show: Peer-to-Peer Conversations” airing January 11 at 9 p.m. NY on Bloomberg Television.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.