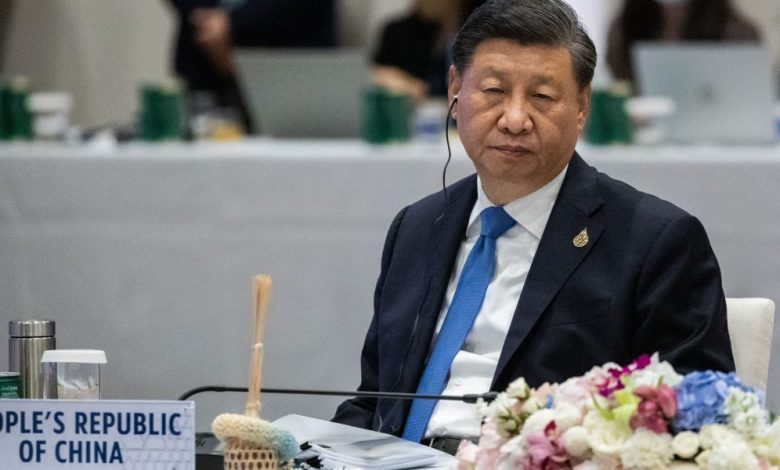

China rally is fading amid investors mistrusting Xi’s power

After spurring a years-long exodus of foreign investors from Chinese markets, President Xi Jinping appeared to have cracked the formula to revitalize its economy and lure back global funds.

China’s very public departure from Covid Zero late last year was accompanied by a speech by Xi in which he reassured senior officials on the importance of attracting and holding foreign funds. The speech, delivered behind closed doors at the Central Economic Work Conference in December and only released in full this month, heralded a series of pro-market turns for hard-hit sectors like real estate and big tech — as well as a crucial shift in tone from regulators and state media .

The result was a world-best stock rally in Hong Kong, a record winning streak for Chinese junk-dollar debt and the strongest momentum for the yuan in five years. Wall Street strategists recommended the country’s assets. One wealth manager described it as the “easiest” trade in the world, and even longtime skeptics like Morgan Stanley agreed it was time to buy.

But just two months into 2023, that reopening trade is stalling. Hedge funds, which entered the rally late last year, are rapidly reducing risk. Hong Kong’s main equity benchmarks are down more than 10% from their January highs. Bond outflows have resumed. And there has been little catching up to do from the stable, long-term institutional players that Xi wants to attract.

New era

“Most of the market participants we speak to don’t believe that China will come back to the way it did before the trade war,” said Pictet Asset Management’s Jon Withaar. “Ultimately, it comes down to visibility — politics, revenue and geopolitics.”

Money managers looking to China to rebuild confidence are getting mixed regulatory messages from a government that has returned its focus to geopolitics. The rivalry between the superpowers has reached levels last seen in the early days of the Trump administration – and investors risk falling back into the middle. There is also concern that Xi’s greater executive power increases the risk of a political misstep.

Singapore-based Withaar, Pictet’s head of special situations in Asia, said his team decided to significantly reduce its China risk in mid-2021 as Xi cracks down on tech and online tutoring firms. The long-short equity fund Pictet, which he manages, has since kept its exposure to the country low.

Distrust of the Xi government is particularly high among US investors as Xi consolidated his power in October and sought a “shared prosperity” agenda that sparked the government crackdowns.

James Fletcher, founder of Salt Lake City-based Ethos Investment Management, said he would be cautious over the next two to five years, adding that geopolitical tensions and the heavy hand of government would continue to be the norm. This concern has been underscored by recent reports that Xi will parachute key allies to run the central bank.

“We are investing in an environment with fewer controls and more power consolidation, which we believe means greater regulatory risk,” he said.

Santa Monica-based Belita Ong, chair of Dalton Investments, said her firm bought some Chinese stocks late last year after falling sharply, but sold them.

“Entrepreneurs are penalized for speaking up and creativity is dampened,” Ong said on Bloomberg TV this month. “These things make it really difficult for us to invest in China.”

The Ministry of Finance recently ordered state-owned companies to avoid the four largest international accounting firms, which will further remove foreigners from China’s corporate landscape. And the disappearance of a high-profile investment banker this month has fueled fresh doubts about whether Xi’s crackdown on private companies has run its course.

The saga of the suspected Chinese spy balloon shot down by the US underscores the growing disunity in Xi’s efforts to woo investors from countries that are its direct strategic rivals. Shortly after the balloon hovered over military installations in Montana, the Biden administration expanded its blacklist of Chinese companies banned from buying US goods.

The number of restrictions on Chinese securities Americans can own is also increasing, and Beijing is not easing its sanctions on US firms.

All of this means that even if Beijing policymakers take bolder steps to shore up the economy, market confidence remains weak. There is continued reluctance to move into the country in the long term, showing how much the trauma of the past two years has inflicted on China’s credibility abroad.

hope for pragmatism

Karine Hirn of Sweden-based East Capital Asset Management, who saw the value of her firm’s assets in Russia wiped out by the war in Ukraine and subsequent sanctions, predicts nothing similar on the horizon for China.

She is counting on Xi to be pragmatic and make growth his priority. However, Hirn doesn’t rule out the risks, adding that China and global investors have entered “uncharted territory” after the regulatory onslaught that began in late 2020.

The key now is to “listen to market feedback and be more responsive,” said Patrick Law, who runs Bank of America Corp.’s forex trading business. in the Asia-Pacific region. “It’s gotten complicated now — bitten once, shy twice.”

There are some signs the authorities are trying.

China’s securities regulator February 1 sought public feedback on draft rules for new stock listings before rolling them out. In addition, the guidelines for brokerage firms offering cross-border services have been clarified. And there has been a spate of approvals being given to global financial firms to fully operate their onshore operations in China.

Much may depend on the experiences of international visitors, who are now flocking to mainland China for the first time since the pandemic, said Sean Debow, chief executive officer of Eurizon Capital Asia.

Strategists at Goldman Sachs Group Inc. are forecasting price returns of about 20% from Chinese stocks over the next 12 months, based on the company’s earnings and valuation projections.

Regardless, it will take an extended period of calm on both the regulatory and geopolitical fronts to restore the confidence investors need, according to Julien Lafargue, chief market strategist at Barclays Plc’s private bank in London.

“I don’t think it’s necessarily going to happen in the short term,” he said. “The healing process will take a long time.”

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.