Bankman-Fried’s “I Screwed Up” screenplay about punishment vs. prison: Attorney

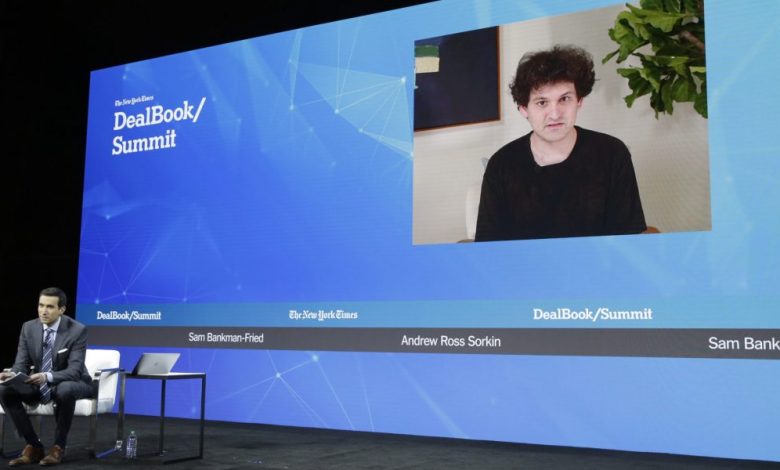

FTX Founder Sam Bankman-Fried experienced an “I screwed it up” media blitz this week, highlighted by his video appearance at the New York Times DealBook summit on Wednesday and continuation on the talk shows on Sunday.

US securities attorney James Murphy, speak with CNN’s Quest means business On Thursday, Bankman-Fried said he “did a very good job of sticking to his talking points.”

Murphy said, “His talking points were, ‘I didn’t do anything wrong on purpose. I may have been negligent. I may have breached a fiduciary obligation.’ But both of those things will get you sued and penalized. They won’t put you in jail. And so he stayed away from anything that sounded like willful misconduct.”

FTX imploded in spectacular fashion last month, spurring calls for tighter regulation and shaking confidence in the crypto sector. The $32 billion cryptocurrency exchange had established itself as a leader in the field, enlisting star athletes like Stephen Curry and other celebrities to boost its image.

A key allegation against Bankman-Fried is that he used client funds from his crypto exchange to fund risky bets at affiliated trading arm Alameda Research.

“Never tried to commit fraud”

In the DealBook interview, Bankman-Fried spiced his testimony with legal language, stating that he “never attempted to defraud anyone,” “didn’t have a history of lying,” and “did not knowingly mix funds.” ”

Murphy of Bankman-Fried stuck to the script: “He’s a very, very smart man and he did it for an hour.”

in one financial times In an interview published Sunday, Bankman-Fried stayed on topic, saying, “I screwed it up big and people got hurt.”

On ABC’s In this week On Sunday, Bankman-Fried said: “Look, I screwed up. As CEO, I had a responsibility here and the responsibility to keep track of what was happening on the stock exchange. I wish I could have done that much better.”

ABC legal analyst Dan Abrams said afterwards, “His basic defense, it seems, is, ‘I didn’t mean to. I didn’t try to do it.’ In many cases this is not enough. That doesn’t necessarily protect him from prosecution. But it’s something we hear from CEOs trying, and it almost never works.”

“People will go to jail and should go to jail”

Abrams added that Bankman-Fried could face a long prison sentence.

“We’re talking about the possibility of a life sentence, by the way,” he said. “When you’re talking about that much money, in the federal sentencing guidelines, you’re talking about the possibility of improvement after improvement after improvement based on the dollar amounts that could result in something life threatening.”

Earlier this week, Coinbase CEO Brian Armstrong said of Bankman-Fried, “It’s “baffling to me why he isn’t already in custody.”

Mark Cuban, billionaire owner of the Dallas Mavericks and prominent crypto investor, recently told TMZ that Bankman-Fried should be worried about jail time.

Mike Novogratz, CEO of crypto firm Galaxy Digital Holdings, told Bloomberg TV on Thursday, “Sam and his colleagues continued a scam… He took our money. And that’s why he needs to be prosecuted. People will go to jail and should go to jail.”

Securities attorney Murphy added that prosecutors do not have to prove securities fraud. “They can deal with mail and wire fraud,” he said. “If the money has been misappropriated from customers and given to this affiliate Alameda, that is fraud and should be covered by the statutes. I sincerely hope that our Department of Justice looks at this very closely.”

wealth reached out to Bankman-Fried for comments, but received no immediate response.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.