Africa’s economic growth exceeds global forecast in 2023-2024 – African Development Bank Semi-Annual Report | African Development Bank

Diplomat.Today

The African Development Bank

2023-01-19 00:00:00

——————————————-

Africa will outperform the rest of the world in terms of economic growth over the next two years, averaging real gross domestic product (GDP) of around 4% in 2023 and 2024.

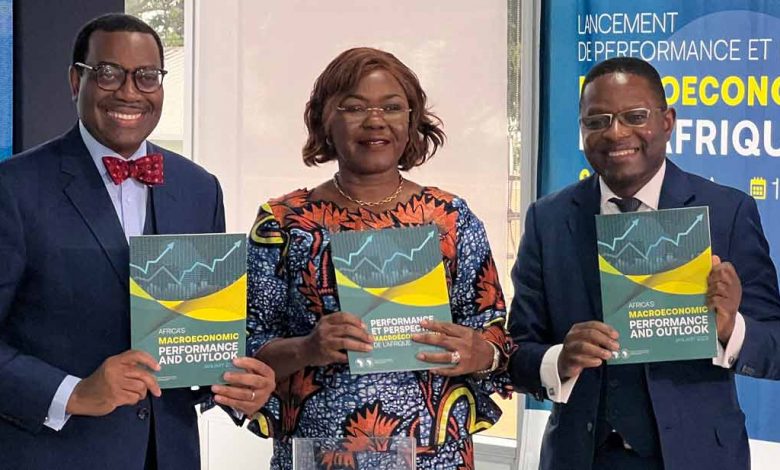

This is higher than the expected global averages of 2.7% and 3.2%, the African Development Bank Group said in Africa’s Macroeconomic Performance and Outlook report for the region, released in Abidjan on Thursday.

With a comprehensive regional growth analysis, the report shows that all five regions of the continent remain resilient with stable medium-term prospects, despite significant headwinds from global socio-economic shocks. It also identified potential risks and called for robust monetary and fiscal measures, backed by structural policies, to address them.

The Macroeconomic Performance and Outlook report will be published in the first and third quarters of each year. It complements the bank’s existing annual African Economic Outlook report, which focuses on key emerging policy issues relevant to the continent’s development.

The report shows that Africa’s estimated average real GDP growth slowed to 3.8% in 2022, from 4.8% in 2021, amid significant challenges posed by the Covid-19 shock and the Russian invasion from Ukraine. Despite the economic slowdown, 53 of the 54 African countries recorded positive growth. All five regions of the continent remain resilient with stable medium-term prospects.

However, the report issues a warning about the outlook due to current global and regional risks. These risks include rising food and energy prices, tightening global financial conditions and the associated increase in domestic debt servicing costs. Climate change – with its detrimental impact on domestic food supplies and the potential risk of policy reversal in countries holding elections in 2023 – poses an equally significant threat.

The report calls for bold policy action at national, regional and global levels to help African economies mitigate the risks that go together.

In remarks during the launch, Dr. Akinwumi Adesina, president of the African Development Bank Group, said the release of the new report came at a time when African economies, facing significant headwinds, were proving their resilience.

“With 54 countries in different growth phases, different economic structures and diverse resources, the spillover effects of global shocks always vary by region and by country. Slowing global demand, tighter financial conditions and disrupted supply chains therefore had different consequences for African economies,” he said. “Despite the confluence of multiple shocks, growth was positive in all five African regions in 2022 – and the outlook for 2023-2024 is expected to be stable.”

Niale Kaba, Minister of Planning and Development of Ivory Coast, said: “The publication of this report by our bank, the African Development Bank Group, at this time of year is an excellent opportunity for Africa and its global partners. We need these regular updates to assess the macroeconomic performance and outlook of our countries. This reliable information will aid decision making and risk management for potential investors in Africa.”

Africa’s top five pre-Covid-19 economies are expected to grow at an average rate of more than 5.5% in 2023-2024, reclaiming their position among the world’s 10 fastest growing economies. These countries are Rwanda (7.9%), Ivory Coast (7.1%), Benin (6.4%), Ethiopia (6.0%) and Tanzania (5.6%).

Other African countries are expected to grow by more than 5.5% over the period 2023-2024. They are the Democratic Republic of Congo (6.8%), Gambia (6.4%), Mozambique (6.5%), Niger (9.6%), Senegal (9.4%) and Togo (6.3 %).

At its launch, economist Jeffrey Sachs, director of the Center for Sustainable Development at Columbia University, praised the report, which he said showed that African economies are growing and growing consistently.

Sachs, who is also UN Secretary-General Antonio Guterres’s advocate for sustainable development goals, said: “Africa can and will consistently grow at a growth rate of 7 percent or more per annum for decades to come. What we will see, building on the resilience we see in this report, is a real acceleration of Africa’s sustainable development, so that Africa will become the fastest growing part of the global economy. Africa is the place to invest.”

Bold policy actions to help African economies mitigate rising risks

The report calls for robust measures to address the risk. These include a mix of monetary, fiscal and structural policies, including:

- Timely and aggressive monetary tightening in countries with acute inflation, and prudent policy tightening in countries where inflationary pressures are low. Coordination with fiscal policy will further strengthen levers to alleviate inflationary pressures.

- Increase resilience by boosting intra-African trade, especially in product manufacturing, to cushion economies against volatile commodity prices.

- Accelerate structural reforms to build tax administration capacity and invest in digitalisation and e-governance to increase transparency, reduce illicit financial flows and scale up domestic resource mobilisation.

- Improving institutional governance and establishing policies that can boost private sector finance, particularly in climate-resilient and pandemic-resilient greenfield projects, and mobilize Africa’s resources for inclusive and sustainable development.

- Take decisive action to reduce structural budget deficits and the build-up of public debt in countries at high risk of debt or already indebted.

Overview of economic prospects between regions

Despite the confluence of multiple shocks, growth was positive in all five African regions in 2022 – and the outlook for 2023-2024 is expected to be stable.

- Central Africa-Supported by favorable commodity prices, growth was estimated to have been the fastest on the continent at 4.7%, up from 3.6% in 2021.

- South Africa-Growth decelerated the most, to around 2.5% in 2022 from 4.3% in 2021. This slowdown reflects subdued growth in South Africa, where higher interest rates, weak domestic demand and continued power outages weighed on the economy.

- West Africa –Growth is estimated to have slowed to 3.6% in 2022 from 4.4% in 2021. This reflects slowdowns in Ivory Coast and Nigeria, the region’s two largest economies. Nigeria’s growth in 2023 – while hit by Covid-19, insecurity and weak oil production despite higher international oil prices – could benefit from continued efforts to restore security in the troubled oil-producing region.

- North-Africa –Growth is estimated to have fallen by 1.1 percentage points to 4.3% in 2022 from 5.4% in 2021 due to the strong contraction in Libya and the drought in Morocco. Growth is expected to stabilize at 4.3% in 2023, supported by an expected strong recovery in the two countries and continued growth elsewhere in the region.

- East Africa-Growth is estimated to have slowed to 4.2% in 2022, from 5.1% in 2021. However, it is expected to recover to the pre-pandemic average of more than 5.0% in 2023 and 2024. Although the production structure in East Africa is relatively diversified, the region is largely net importers of raw materials. They thus bear the brunt of high international prices alongside recurring climate shocks and insecurity, particularly in the Horn of Africa.

In his presentation, Kevin Urama, acting chief economist and vice president of the African Development Bank, noted that Africa continues to be a favorable destination for investment in human capital, infrastructure, private sector development and natural capital.

Urama said: “Africa plays an important role in driving inclusive growth and sustainable development globally. There are many smart investment opportunities in key sectors: agriculture, energy markets, minerals, health infrastructure and pharmaceuticals, light manufacturing, transport and logistics, digital economy and more. The continent continues to be a global treasure trove for savvy investors.”

For more information and to download the report, click here.

——————————————-