African Development Bank Launches USD 2 Billion 4.375% Global Benchmark for March 14, 2028 | African Development Bank

Diplomat.Today

The African Development Bank

2023-03-09 00:00:00

——————————————-

The African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s/S&P/Fitch/Japan Credit Rating, all stable), has launched a USD 2 billion 5-year Global Benchmark bond, priced at March 14, 2028, the first of the year. The bond was issued on March 7.

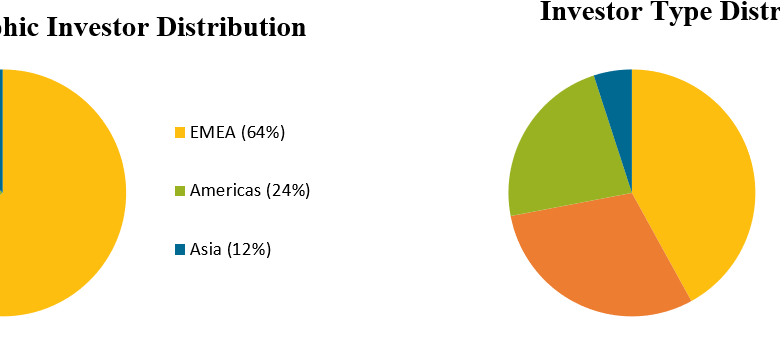

With this issuance, the African Development Bank continues its funding strategy of issuing large liquid benchmark transactions and adds another on-the-run benchmark over the 5-year term while extending its outstanding USD curve. With a closing order book in excess of USD 3.5 billion and 95 participating investors, the African Development Bank set the size of the transaction at USD 2 billion. The issue attracted interest from top quality investors, with particularly good demand from central banks/officials.

The Bank’s mandate for a 5-year USD Global Benchmark was announced on Monday, March 6 at 09:07 London time, with Initial Pricing Thoughts (IPTs) released on mid-swaps plus 35 bps (basis points) area at 12:34 p.m. London time.

The deal enjoyed good investor interest during the first afternoon and night, with Indications of Interest (IoI) reaching $2.1 billion by the official opening of the timebooks on Tuesday, March 7, 2023 at 07:57 London Time. The order book continued to grow throughout the morning in Europe, with investor demand of USD 3.5 billion at 10:28 am London time, allowing the spread to narrow by 2 basis points and set at SOFR mid-swaps + 33 basis points. Shortly thereafter, at 12:54 pm London time, the high order book enabled the transaction to be launched at USD 2 billion, with the US books closing at 1:30 pm London time. The price of the trade was official at 5:58 p.m. London time at SOFR mid-swaps plus 33 bps, representing a reoffer yield of 4.435% and a spread of 14.3 bps against the on-the-run 5-year US Treasury.

Closing the final order book of over USD 3.5 billion with more than 90 orders, the success of this 5-year transaction is a clear vote of investor confidence in the Bank’s AAA credit.

Investor Distribution Statistics:

Transaction details:

|

Publisher: |

African Development Bank (“AfDB”) |

|

Issuer Rating: |

AAA / AAA / AAA (all stable) |

|

Mate: |

$2 billion |

|

Price date: |

March 7, 2023 |

|

Settlement Date: |

March 14, 2023 |

|

Expiration date: |

March 14, 2028 |

|

Coupon: |

4.375% |

|

Spread to mid-swaps: |

+33fps |

|

Spread by benchmark: |

+14.3 fps |

|

Offer price again: |

99.734% |

|

Resubmit Yield: |

4.435% |

|

Chief Managers: |

Barclays, Crédit Agricole CIB, Deutsche Bank, JP Morgan, TD Securities |

|

Co-Head Manager: |

Castle Oak Effects |

|

IS IN |

US00828EER62 |

——————————————-