Activist investor Elliott Management takes a big stake in Salesforce

Hedge fund Elliott Investment Management has taken a substantial activist stake in Salesforce Inc., making its move following layoffs and a deep swoon at the enterprise software giant.

Elliott, who often pushes strategic changes and seeks representation on the board, has taken a multibillion-dollar stake in the company, according to a person familiar with the matter. The San Francisco-based company’s market cap is now $151 billion, down from a peak of more than $300 billion in 2021.

“Salesforce is one of the preeminent software companies in the world, and after being with the company for almost two decades, we have developed great respect for Marc Benioff and what he has built,” said Jesse Cohn, managing partner at Elliott, in an explanation . “We look forward to working constructively with Salesforce to realize the value befitting a company of its size.”

Benioff is Chairman and Co-CEO of Salesforce. Elliott did not provide details about his investment in the statement, which was first reported by The Wall Street Journal.

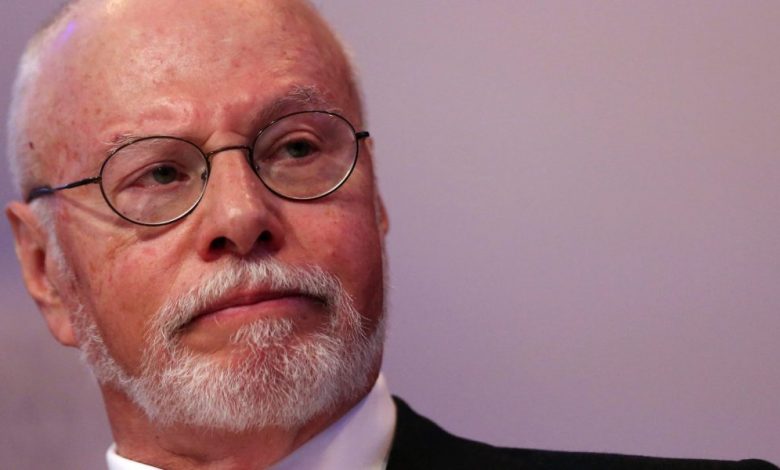

Paul Singer’s Elliott grossed a record $13 billion last year

Elliott, who helped transform technology companies from PayPal Holdings Inc., Pinterest Inc. to Western Digital Corp. is the second prominent activist investor to get into the stock in recent months. In October, Starboard Value took a stake in the company and said the company was struggling to convert growth into profitability.

Salesforce said earlier this month it was shedding about 10% of its workforce and reducing its real estate holdings after hiring too many people during the Covid pandemic as demand rose. The company, which had about 80,000 employees at the time, said it was adjusting as customers were more cautious about spending.

Salesforce had nearly tripled its workforce over the past four years, in large part through dozens of acquisitions, including its 2021 purchase of Slack for $27.7 billion. From January 2020 to the end of October last year, the number of employees grew by more than 30,000.

“This is not surprising to us,” Anurag Rana, an analyst at Bloomberg Intelligence, said of Elliott’s move. “Since announcing the acquisition of Slack, Salesforce’s valuation has declined, and since then we’ve seen a slowdown in sales and multiple executive departures.”

Bret Taylor, who was Salesforce’s co-CEO, said last year that he was leaving the company to return to entrepreneurial pursuits. Taylor was seen as the obvious choice if Benioff ever resigned from Salesforce.

“It is now trading well below its pre-pandemic levels,” Rana added. “Elliott’s involvement could help management focus on both organic sales growth and margin enhancement. We won’t be surprised if there is a change at the top as well, much like Microsoft did in 2013.”

–With support from Tom Giles.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Sign up here.