Goldman Sachs makes a bold call to the housing market

The US real estate market could finally be at the bottom. At least that’s what Goldman Sachs says.

Just two weeks after Goldman Sachs downgraded its US housing market outlook in a paper titled “Get Worse Before It Gets Better,” the investment bank returned on Jan. 23 in a paper titled “2023 Housing Outlook: Finding a Trough” changes the course.

Instead of US home prices falling 6.1% in 2023, which was their Jan. 10 forecast, researchers at the investment bank now expect national home prices to fall just 2.6% by the end of 2023.

By the time U.S. home prices bottom this summer, national home prices will be down about 6% from their peak in June 2022, according to Goldman Sachs. Previously, researchers at Goldman Sachs had expected the peak-to-trough decline to be closer to 10%.

“We expect national home prices to fall by about 6% from peak to trough and for the price decline to stop around mid-year. At a regional level, we project larger declines in the Pacific Coast and Southwest regions — which on average have seen the largest inventory increases — and more modest declines in the Mid-Atlantic and Midwest — which have maintained greater affordability in recent years,” Goldman Sachs researchers wrote.

Why the upward revision? Recent data, says Goldman Sachs, suggests an increase in demand from homebuyers.

“Home sales appear to be rising. Mortgage purchase applications in January so far have averaged 9% above their October low, and survey-based measures of purchase intent have rebounded strongly,” researchers at Goldman Sachs wrote.

To get a better idea of where both national and regional property prices might be headed, wealth asked Goldman Sachs to provide us with their full guidance.

Let’s take a look.

Unlike KPMG, Goldman Sachs does not expect a double-digit house price correction. The investment bank says there are three reasons why there won’t be a steeper correction this cycle.

“First, the rapid build-up of idle home equity in recent years means that even if prices fell more than expected, only a small fraction of mortgage borrowers would be underwater,” the Goldman Sachs researchers wrote. “Second, over 90% of those outstanding are Mortgages are fixed rate, which means that the rise in interest rates will not result in an increase in debt servicing costs for most homeowners. And third, household balance sheets remain strong, with low overall debt and a sizeable balance of pent-up savings from the COVID-19 pandemic.”

These three factors, according to Goldman Sachs, should prevent the potential for “cascading defaults that have contributed to the decline after the global financial crisis.” That previous correction — following the 2007-2008 global financial crisis, which saw US home prices fall 26% between 2007 and 2012 — is four times larger than the 6% peak-to-trough fall forecast by Goldman Sachs this time.

While Goldman Sachs expects national home prices to fall just 2.6% in 2023, not every market will be so lucky.

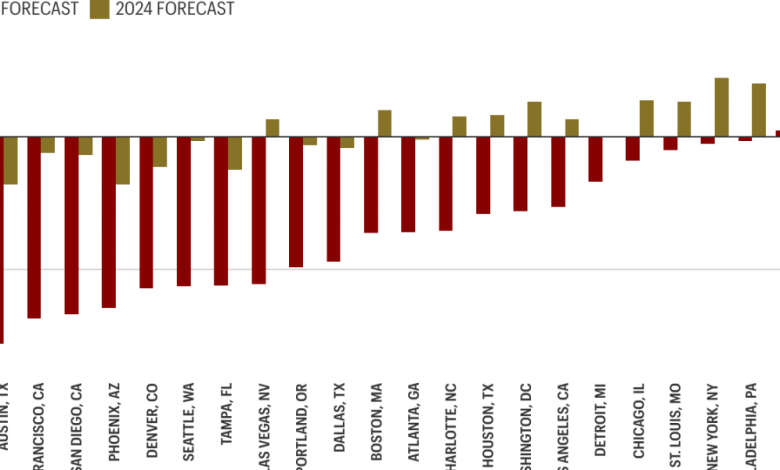

In 2023, Goldman Sachs expects double-digit home price declines in overheated markets like Austin (-16%), San Francisco (-14%), San Diego (-13%), Phoenix (-13%), Denver (-11%) , Seattle (-11%), Tampa (-11%) and Las Vegas (-11%). On the positive side, Goldman Sachs expects home prices to rise in markets like Baltimore (+0.5%) and Miami (+0.8%).

“Trends at the metro level are driven by a tug of war between housing demand and supply. MSA’s [metros] more affordable metro areas like Chicago and Philadelphia — for which paying off new mortgages costs only about a quarter of monthly income — are likely to see smaller house price declines than poorly-affordable metro areas like many Western cities — some of which take mortgage payments as much as three-quarters of monthly income ‘ write the researchers at Goldman Sachs in their latest release.

On the mortgage rate front, Goldman Sachs says buyers shouldn’t expect much relief. By the end of 2023, the investment bank expects the average interest rate for 30-year fixed-rate mortgages to rise again to 6.5%. As of Thursday, the average interest rate on 30-year fixed-rate mortgages is 6.09%.

Looking for more housing predictions? Follow me on Twitter at @NewsLambert.

Learn how to navigate and build trust in your organization with The Trust Factor, a weekly newsletter exploring what leaders need to succeed. Login here.