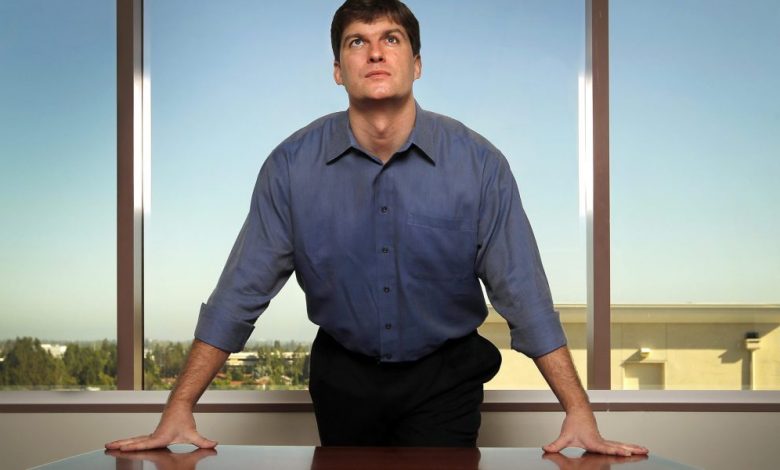

Hedge fund Michael Burry of ‘The Big Short’ warns of ‘prolonged multi-year recession’

Michael Burry rose to fame after predicting the 2008 US housing crash and managing to rake in $100 million in personal winnings and another $700 million for his investors on a few lucrative mismatched bets.

Now the head of Scion Asset Management is warning that economic forecasts for a “soft landing” — or even a “mild recession” — are overly optimistic.

“What strategy will get us out of this real recession?” he wrote in a Tuesday tweetwhat has been since turned off. “What forces could pull us like this? There are none. So we really do face an extended multi-year recession.”

Burry has long argued that US consumers will spend their savings, inflation will persist and corporate earnings will take a hit, meaning a recession is all but guaranteed.

Now he says this recession could last much longer than most investment banks expect because rising inflation limits the ability of the Federal Reserve and the federal government to intervene to spur economic growth.

The hedge fund portrayed by actor Christian Bale in the 2015 film The Big Short is sounding the alarm over the possibility of a devastating recession. And while some have criticized his consistently pessimistic outlook — and patchy track record — he’s made some forward-looking predictions of late.

Just before the crypto winter in June 2021, Burry warned crypto investors that “the mother of all crashes” was imminent. Since then, the value of the crypto industry has dropped from around $3 trillion to around $850 billion, according to CoinMarketCap.

Burry also called the stock market the “biggest-ever speculative bubble in anything” in 2021, before the S&P 500 plummeted 18% that year.

Still, Burry’s predictions don’t always come true. In July, after the S&P 500 posted its worst first-half performance since 1970, the hedge fund warned the index could fall to 2800 this year. But it’s actually been trading flat since then — with some volatility in between.

However, Burry has put his money where his mouth is when it comes to his bearish predictions.

During the second quarter, he reduced Scion Asset Management’s holdings to a single private prison stock, The GEO Group, and exited 11 other stocks, including Alphabet and Meta.

But in the third quarter, Burry added five small new positions, including stakes in another private prison company called CoreCivic, media conglomerate Qurate Retail, telecommunications companies Charter Communications and Liberty Latin America, and missile maker Aerojet Rocketdyne Holdings, SEC filings show.

However, after his stock purchases went public, Burry tweeted, “You have no idea how small I am.”

In his recent tweet, Burry also criticized other forecasters for not predicting a deeper recession. But Nouriel Roubini, professor emeritus at New York University’s Stern School of Business and CEO of Roubini Macro Associates, who has argued that the economy could be facing “a variant of another Great Depression,” was quick to react.

“Some of us have predicted a long and deep recession and detailed why we are headed for a major stagflationary debt crisis,” he said tweeted to Burry on Wednesday.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.