Where real estate prices are going in 2023 – this map shows CoreLogic’s revised forecast for 392 real estate markets

When a buttoned-up Fed economist says the US housing market is in a “difficult [housing correction”], it would be wise to believe them. When it comes from Fed Chair Jerome Powell’s lips, it’s more of a warning.

Powell is right: not only is housing activity continuing to slump, US house prices are also falling for the first time since 2012.

Unlike the housing correction of the 2000s, when US house prices fell by 27% between 2006 and 2012, this ongoing housing correction is not underpinned by bad loans or a supply glut. Instead, what is driving this correction wealth calls “pressurized affordability”. The 43 percent surge in U.S. home prices from the pandemic housing boom coupled with rising mortgage rates has simply pushed affordability beyond what many borrowers can stomach.

The only leverage available to reduce affordability is either falling mortgage rates or house prices. In recent months we have seen the latter.

“Real estate prices remain under significant pressure given rising borrowing costs,” said Selma Hepp, deputy chief economist at CoreLogic happinesse. “[The] A significant drop in demand from homebuyers will continue to push home prices down and bring them closer to local incomes.”

Nationwide, home prices are down 1.3% from their peak in 2022. At least that’s what the delayed Case-Shiller data through August suggests. However, markets like Austin and Reno are down 10.2% and 8.4%, respectively, while markets like Des Moines and Baltimore remain at their all-time highs. (Here’s the shift in the nation’s 400 largest markets.)

But what’s next?

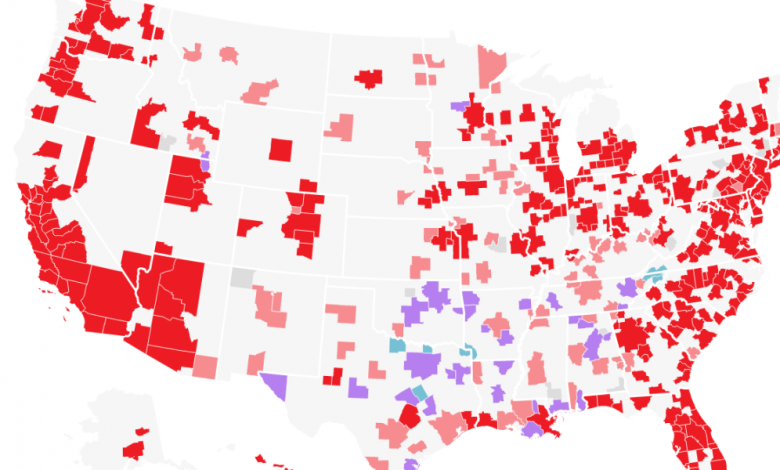

To better understand where regional property prices could be headed in 2023, wealth reached out to CoreLogic to see if the company would provide us with its updated November assessment of the country’s largest regional housing markets. To determine the likelihood of a regional home price decline, CoreLogic evaluated factors such as income growth forecasts, unemployment forecasts, consumer confidence, debt-to-income ratio, affordability, mortgage rates and inventory levels. Then, CoreLogic categorized the regional housing markets into one of five categories, grouped by the likelihood that house prices in that particular market will fall between September 2022 and September 2023. Here are the groupings the real estate research firm used for the November analysis:

- Very high: Over 70% chance of a price drop

- High: 50%-70% probability

- Middle: 40-50% probability

- Low: 20-40% probability

- Very low: 0-20% chance

Of the 392 regional housing markets CoreLogic measured, zero markets currently have “very low” chances of falling home prices over the next 12 months. A further 6 residential markets are in the “low” group and 33 markets in the “medium” group. Meanwhile, CoreLogic ranked 65 markets in the “high” camp and 289 markets in the “very high” quota camp.

The direction is clear: the list of US regional housing markets heading negative on a year-over-year basis is growing. To see the shift, simply compare CoreLogic’s November 2022 rating (see chart above) to May 2022 rating (see chart below).

The November assessment finds that 354 markets have a greater than 50% chance of turning negative year-on-year over the next 12 months (ie markets in the ‘high’ or ‘very high’ risk groups). That’s up from 335 markets in October that had a more than 50% chance of falling home prices. In August, 125 markets were at risk. In July, 98 markets were at risk. In June, 45 markets were at risk. And in May, only 26 markets (see chart above) fell into these “high” or “very high” risk camps.

What’s happening? The house price correction continues to spread.

It didn’t take long for Bay Area techies to realize in 2020 that their newfound remote freedoms, coupled with historically low mortgage rates, made the pandemic the perfect time to shop in “zoomtowns” like Boise.

First, it didn’t matter that the housing boom of the pandemic had caused Boise house prices to be significantly decoupled from local incomes. Well, that was until rising mortgage rates messed up the math of selling your house in Santa Clara and moving to Boise. As this migration slowed, Boise quickly entered a historically sharp correction.

The correction is so severe that Boise — which hit its year-high of 47% between July 2020 and July 2021 — has already turned negative year-on-year in 2022. In fact, home prices in Boise are down 7.1% and 4.3% year over year since their peak in 2022.

To date, only 1% of the country’s 392 largest housing markets are negative on a year-on-year basis. That said, don’t ignore Boise. The big question: Are markets like Boise correcting just because their fundamentals are so out of whack? Or are markets like Boise just correcting First because their fundamentals are so out of whack? Analysis provided by CoreLogic – which finds 354 markets have a “high” or “very high” risk of being negative year-on-year in September 2023 – suggests it could be the latter.

Would you like to be kept up to date on the apartment correction? Follow me on Twitter at @NewsLambert.

Our new weekly Impact Report newsletter will examine how ESG news and trends are shaping the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.