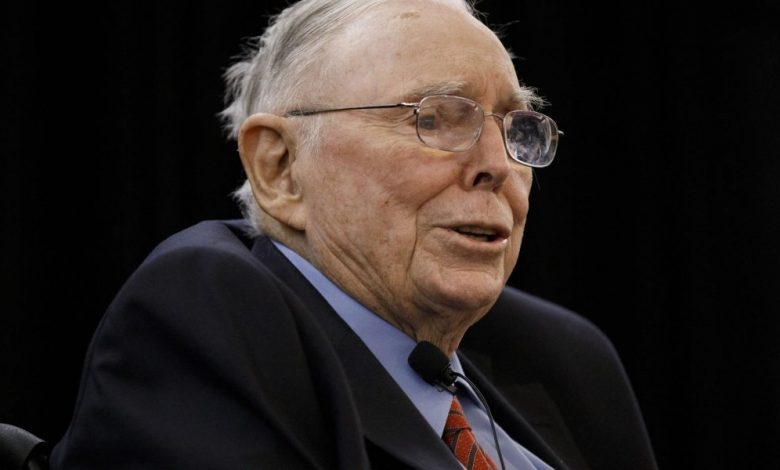

Charlie Munger on the demise of crypto and the Fed, the party and the punch bowl

Warren Buffett’s right-hand man and Berkshire Hathway vice chairman Charlie Munger has been a vocal critic of cryptocurrencies, previously likening them to “venereal diseases” and saying that anyone selling crypto is either “delusional or evil.”

Following FTX’s collapse earlier this month, Munger amplifies those criticisms.

“It’s part fraud and part deception,” he told CNBC Squawk Pod. “It’s a bad combination. I don’t like deceit or deception, and deception can be more extreme than deception.”

Munger added that he doesn’t believe crypto is a real asset — and it should never have been allowed.

“That’s a very, very bad thing,” Munger said. “The country didn’t need a currency that was good for kidnappers… There are people who think they have to be on every hot deal. They don’t care if it’s child prostitution or bitcoin. When it’s hot, they want to be there. I find that totally crazy.”

When it comes to the Federal Reserve, however, Munger has had kinder things to say than some of his other billionaire investor peers.

He argued against the idea that the Fed should be held responsible for potentially pushing the economy into recession in order to bring inflation down to 2%.

The Fed is “ready to have a little recession to not have runaway inflation” — they should, he said. “You’re supposed to be the only guy at the party who isn’t hanging around the bowl and getting drunk.”

His comment refers to an old adage that once the party gets going, it’s the Fed’s job to take the punch bowl, derived from a 1955 speech by Fed Chairman William McChesney Martin, Jr., in which the The responsibility of the institution to prevent high inflation has been described.

But when CNBC’s Becky Quick responded that a lot of people say the Fed is the one that delivered the punch, Munger said, “I think that’s what’s driving it.”

“We were in enough trouble when this thing started that if the Fed hadn’t done what they did – which was very aggressively – we would have had a hell of a mess that would have been a lot worse than what we have now.” . ” he said.

Inflation hit a four-year high of 9.1% yoy in June, before slowing to 7.7% in October. This has raised hopes and expectations that the Fed, after an aggressive stance this year that raised interest rates to a range of 3.75% to 4%, may turn around and slow its pace of rate hikes.

Our new weekly Impact Report newsletter will examine how ESG expectations and issues are influencing the roles and responsibilities of today’s leaders – and how best to address these challenges. Subscribe here.