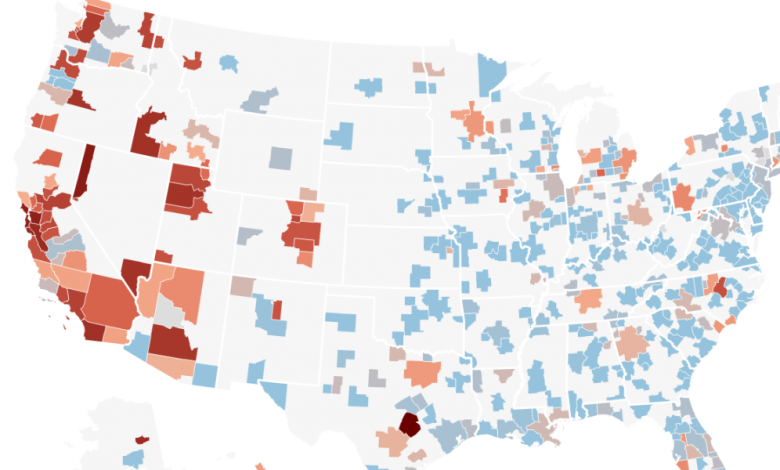

Update: The home price correction in America’s 400 largest housing markets as shown on an interactive map

This kind of impending loss explains why Redfin recently announced it was shutting down its algorithm-powered iBuyer business. As long as the US housing market remains in correction mode, the math just doesn’t make sense.

“When the shiitake mushrooms hit the fan, you [investors] want to go out first. The way to do this is to find where the lowest sell is and 2% below that. And if it doesn’t sell on the first weekend, postpone it [the price] Low [again]said Glenn Kelman, CEO of Redfin, recently wealth.

While finners and builders are scrambling to shift inventories in markets like Las Vegas — where house prices are down 6.93% since their 2022 peak — that’s not the case in all markets (at least not yet). Many markets are still at their peak in 2022. Simply put, the “shiitake mushrooms” haven’t found “the fan” in all markets yet.

To better understand the ongoing housing correction, wealth reviewed the latest Zillow Home Value Index (ZHVI) data.

Among the country’s 400 largest housing markets, 219 property values have seen their values fall below their 2022 peak. The average drop is 2%.

While the home price correction has certainly taken place nationwide, it continues to hit two types of markets harder than others.

The first group are “significantly overvalued” housing markets. These are often either second home markets or boomtowns where property prices have risen during the boom well beyond what local income can support.

Look no further than Austin, which Moody’s Analytics rated as “overvalued” by 61.1% for the second quarter. That foaming could explain why Austin has already seen home values fall 10.21% from its 2022 peak. Not too far behind Austin are other “clearly overvalued” markets such as Reno (where home values are down 8.47%), Boise (-7.06%) and Salt Lake City (-6.89%).

The second group includes high-cost markets along the west coast. Places like San Francisco (where home values are down 8.18%), Santa Cruz (-7.58%) and Seattle (-6.28%). According to John Burns Real Estate Consulting, these markets are very sensitive to mortgage rates. In many cases, they are hit with a double whammy: not only are their high-end housing markets more interest rate sensitive, but so are their tech sectors.

While 219 major markets are below their 2022 highs, another 181 markets remain at their 2022 highs. The ongoing mortgage rate shock has not yet caused Zillow-measured home values in markets like Philadelphia, Baltimore, Virginia Beach, Oklahoma City and Richmond to drop have fallen.

But that doesn’t mean the home price correction won’t hit markets like Virginia Beach and Philadelphia. If mortgage rates remain high and unsold inventory –which remains narrow nationally– continues to build, this could put further downward pressure on house prices.

That’s exactly what Moody’s Analytics expects.

While Moody’s isn’t expecting a 2000s-style housing crash (which saw U.S. home prices fall 27% from peak to trough), it expects U.S. home prices to fall about 10% from peak to trough. That includes declines of 14.2% and 5.3% in markets like Virginia Beach and Philadelphia, respectively. (Here’s Moody’s outlook for the country’s 322 largest markets).

On the one hand, some of these home price corrections in 2022 are pretty big. On the other hand, most of these markets are still going strong since the pandemic housing boom began.

Between March 2020 and May 2022, Austin home values rose 75.36%. Since then, it has taken a -10.21% discount. That brings Austin’s pandemic-related gains down to 57.46%.

Sign up for the Fortune Features Email list so you don’t miss our biggest features, exclusive interviews and investigations.